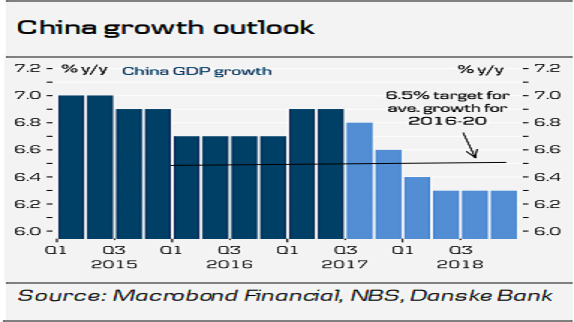

China’s gross domestic product (GDP) is expected to witness a moderate slowdown over the next year due to the financial tightening and measures to cool housing. It is expected to expand 6.8 percent in 2017 and to fall to 6.3 percent in 2018. A hard landing is not likely, though, as residential inventories are low and exports are supported by robust global growth, Danske Bank reported.

When China’s political leaders meet for the 19th Congress of the Communist Party on October 18, they are likely to be very satisfied with the economic and financial developments. After going through a financial storm in 2015 and early 2016 that caused fears of a very hard landing, the situation has turned to one of calm and robust growth.

GDP in the first two quarters came in at a higher-than-expected 6.9 percent and the currency has turned around and strengthened 5% against the USD this year - contrary to market expectations. The goal of stability ahead of the Congress has been achieved.

Xi Jinping is also on track to deliver on the goal of making China a ‘moderately prosperous society’ by 2020. This was formulated as a doubling of income from 2010 to 2020 and when launched in 2015 it required an average growth rate of 6.5 percent. As China’s economy is set to grow 6.75 percent on average in 2016 and 2017, the goal will be reached even with a decline in growth to 6.3 percent on average from 2018-2020. This is clearly within reach.

"We are optimistic, though, that Xi Jinping will put more efforts into economic reforms once he has secured his power base after the Congress," the report said.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility