Chinese economy is slowing down faster than expected. The weakness is somewhat masked by the country's GDP number, along with currency rate and stock index.

Defaults are lining up across industries.

- Suqian Chief Leather Co., based in Jiangsu province could not pay the bondholders who exercised put option on the bond.

- NBO Machinery Equipment Co., said to have difficulties over coupons and principal repayment.

- Property maker Kaisa group, might payback only 2.4% of the amount due.

- For Dongfei Mazuoli Textile Machinery Co. story is similar.

Worrying signs -

- Investment vehicles - Lot many structured financial vehicles have been sold to retail investors during period of 2010-2014. These vehicles return depends on higher return generated from high yield corporate loans and return from property selling.

- Current signs in the property market says that the bottom is yet not reached.

- Latest report showed property prices are down 66 out of 70 cities surveyed. House price index fell by -5.7%.

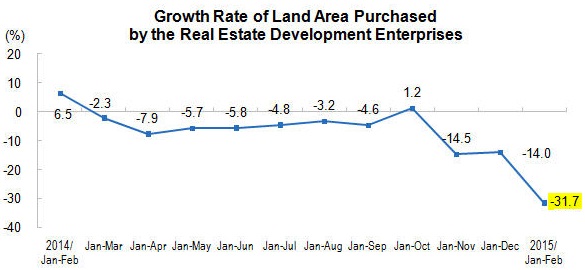

Land is an appreciating assets unlike housing. During boom, land prices rise faster than housing. Moreover demand for land precedes housing boon as first area is required to build. Chart courtesy soberlook.

- Growth rate in land area purchase by developers in China, remained negative throughout 2014. Growth rate fell by -14%. In the first 2 months in 2015, the rate has fallen by staggering 31.7% YoY.

Fear over hard landing in china may rise and dent the consumer and investor confidence such that a run off starts a busting spiral.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings