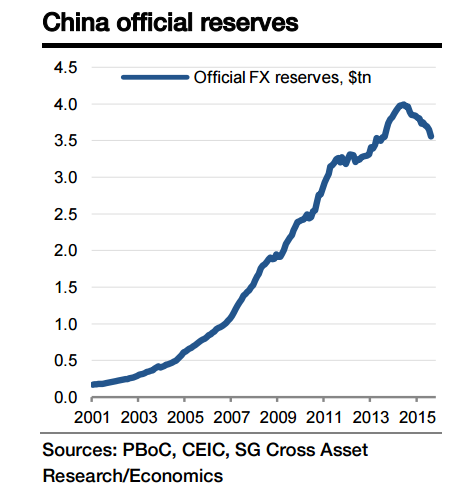

China's FX reserves likely dropped by $57bn in September to $3.50trn, compared with a $94bn decline in August. Since there was little change in major currency valuations vs the USD, the estimated decline implies $55bn of FX intervention by the PBoC, down from $110bn in the previous month.

The PBoC seems to have remained active in the onshore currency market. Onshore CNY spot trading volume averaged around $23.3bn, i.e. lower than the record $31.4bn observed in August but still well above the levels seen before the currency regime change. Also, there have been signs of FX intervention in the offshore CNH market. However, a series of measures have been introduced to tighten capital controls on corporates and households, which may have helped mitigate capital outflow pressures.

In addition, intervention in the derivatives market, which does not leave much of a mark on the current FX reserve data, seems to have taken place as well. Such intervention should show up on the table of "predetermined short-term net capital drains on foreign currency assets", reported monthly by the SAFE. In light of the possibility of state-owned commercial banks selling USD at the behest of the PBoC, the reserve figure could surprise on the upside as it did in August.

China’s FX reserves likely dropped to $3.5trn

Monday, October 5, 2015 9:19 PM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks