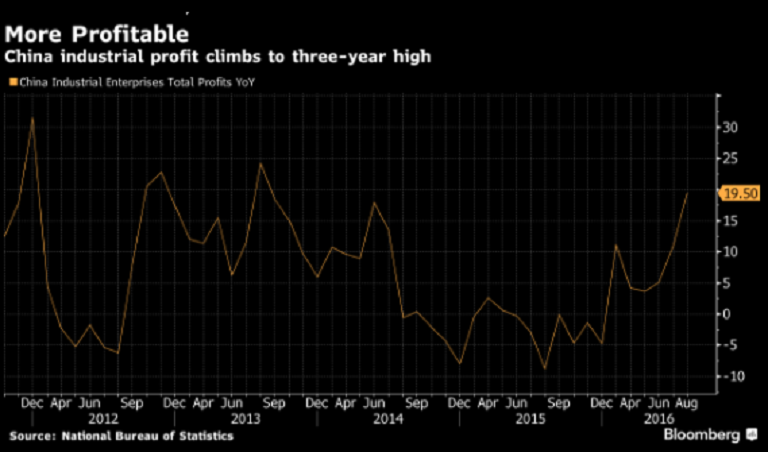

Industrial profits in China soared to a three-year high during the month of August, buoyed by rising sales, higher prices and low costs of production. Amid an economic recovery that is likely to lose pace in the coming months, a rise in the country’s industrial profits has delivered signs of business stabilization.

China’s industrial profits rose 19.5 percent in August from a year earlier to 534.8 billion yuan (USD80.2 billion), data released by the National Bureau of Statistics showed Tuesday. Further, profits rose 11 percent during the month of July, compared to a year earlier period.

"Industrial profits in August have shown positive changes and government policies continue to produce effects," Reuters reported, citing He Ping, Official, NBS official in a statement accompanying the data.

Further, manufacturing profits rose 14.1 percent from a year earlier while mining industry profits fell 70.9 percent. Total profits for the January-August period rose 8.4 percent from the same period a year earlier, compared with a 6.9 percent rise in the first seven months of this year.

Moreover, Chinese industrial firms' liabilities at the end of August were 4.6 percent higher than at the same point last year. However, the statistics agency said that demand still remains weak, both domestic as well as overseas. The time it takes companies to get paid money they’re owed remains relatively long and the traditional manufacturing, especially those with excess capacity are still struggling, Bloomberg reported, citing the agency.

Meanwhile, the Asian Development Bank on Tuesday increased its growth forecast this year for China to 6.6 percent from 6.5 percent and for 2017 to 6.4 percent from 6.3 percent, citing fiscal and monetary stimulus measures.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran