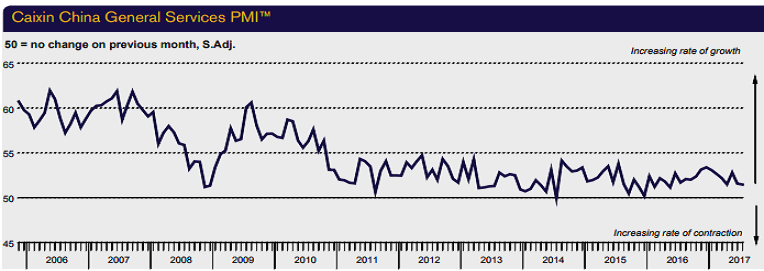

China’s services economy lost further momentum at the start of the third quarter, with July data signalling weaker increases in both activity and new orders. Overall, new business expanded at the slowest rate in 16 months, while business activity grew at the joint-weakest rate for over a year.

At the same time companies raised their staff numbers only slightly, and confidence towards the 12-month business outlook dipped to its lowest level in eight months. Inflationary pressures were relatively muted, with input cost inflation weakening to the lowest in just under a year, while prices charged rose only slightly.

The headline seasonally adjusted Business Activity Index registered 51.5 in July, down fractionally from 51.6 in June to signal only a modest increase in activity. Furthermore, the rate of expansion was the joint-lowest since May 2016 (on par with April 2017). Higher business activity was generally linked by survey respondents to an improvement in underlying market conditions.

However, lower client numbers were cited by some firms as having dampened overall activity growth in the latest survey period. Reflecting this, the amount of new work received by services companies increased at the slowest pace since March 2016. Payroll numbers at Chinese services companies continued to rise in July. That said, the rate of expansion remained marginal overall, despite growth picking up from June’s ten-month low.

Subdued employment growth and higher new orders underpinned a further increase in backlogs of work. However, the rate of accumulation was little-changed from the prior two months and only slight. The rate of input price inflation slowed for the second month running to signal the weakest increase in cost burdens since last August. Companies that experienced higher input prices generally linked this to greater salaries and raw material costs. At the same time, prices charged by services companies continued to increase at a marginal pace.

After strengthening in June, confidence towards the year-ahead moderated at the start of the third quarter. Notably, the degree of positive sentiment weakened to its lowest level in eight months. Optimism was generally linked to new projects, entry into new markets and planned company reforms.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility