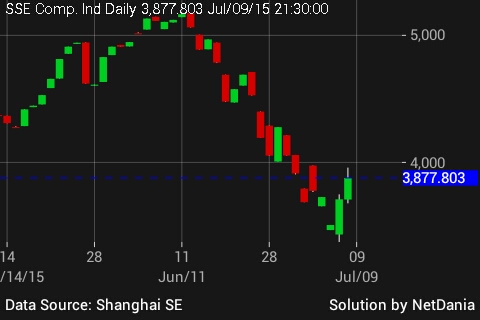

After yesterday's spectacular rise of almost 6%, China's benchmark stock index Shanghai composite is up by another 4.5% today.

Chinese authorities have pushed almost everything from IPO ban to loan refinancing to suspending trading in almost 50% of the listed stocks to stem a stock market crash. They must be feeling relieved after two days of consecutive gains.

However this govt. fuelled rally pose greater risk to Chinese economy and retail customers.

- A signal that govt. stands ready to support the stock market with almost everything is a very dangerous one. China's margin financing in the previous rally was simply outrageous compared to historical standard in any major stock market around the world.

- Recent bounce back could push retail clients to jump back once again with more leverage into the stocks and with new margin financing rules one can bet almost anything tangible even one's house to bet in stock market.

Next downturn in stock market can expose the clients as well as the economy to even greater risk.

Chinese authorities should toughen stance against betting the market and force limited risk exposure rather than encouraging even higher leverage.

Chinese stock market remains most volatile in the world, with 5 day average of realized daily volatility above 7%.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings