Last night, trade report for October was released from Japan. From the broader look it suggests imports dropped -13.4%, while exports dipped -2.1% and merchandise trade balance came at ¥ 111.5 billion, which is highest since April.

While lower import headline might suggest lack of domestic demand or drop due to weaker Yen, a closer look might reveal more than what meets the eye.

- While overall import was down by -13.4%, mineral fuel imports were down by -12.6%, and drop in all other areas are only minor (transport equipment - 0.1%, electrical machinery +0.1%, machinery -0.1%, manufactured goods -0.6%, chemicals +0.7%, raw materials -1.4%)

- Compared to imports, exports were down just by -2.1%, majority of which came from manufactured goods (-1.1%) and chemicals (-0.8%), followed by machinery (-0.4%).

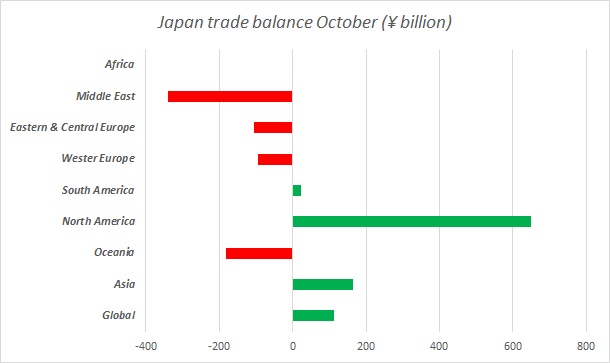

- Geographical distribution showed imports are down -3.6% from Asia, -22.9% from South America, -19.5% from Central and Eastern Europe and -25.4% from Africa, while up 3% from Middle East, 4.7% from western Europe, 5.9% from North America and 2.1% from Oceania.

- Similarly, Exports are down -4.7% to Asia, -26.2% to Oceania, -1.6% to North America, -13.1% to South America, -7.7% to Central and Eastern Europe, -51.5% to Middle East and -20.8% to Africa, while up 6.3% to western Europe.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand