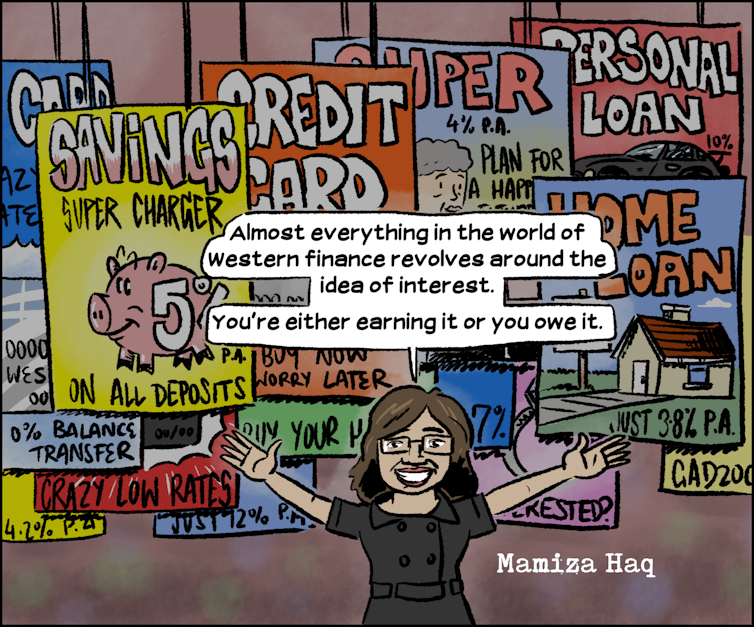

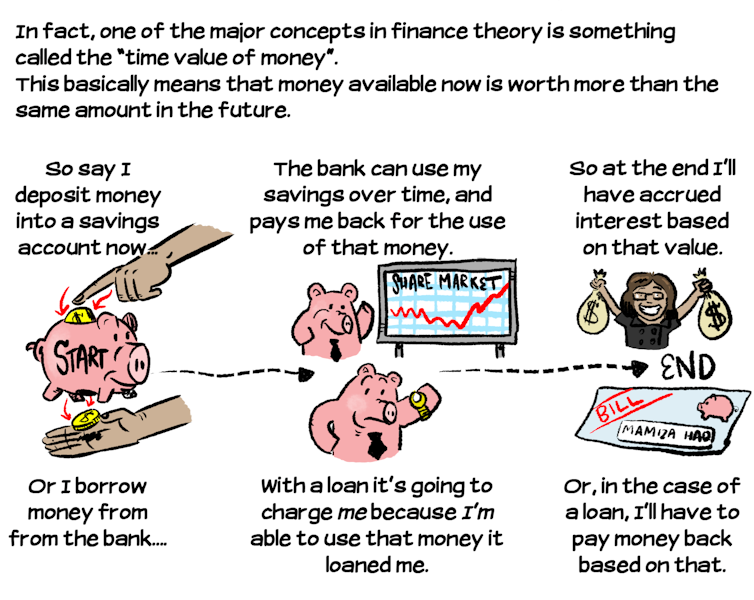

Interest fuels the financial world. The money sitting in your bank account accrues it, and the credit cards in your wallet charge it. If you ever want money quick, you’re going to being paying a decent amount of interest for having that money now rather than later.

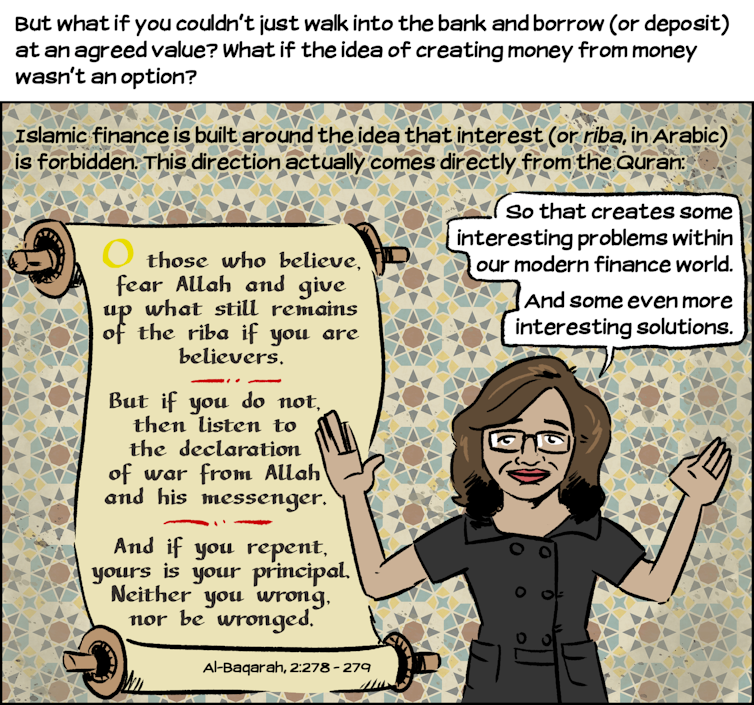

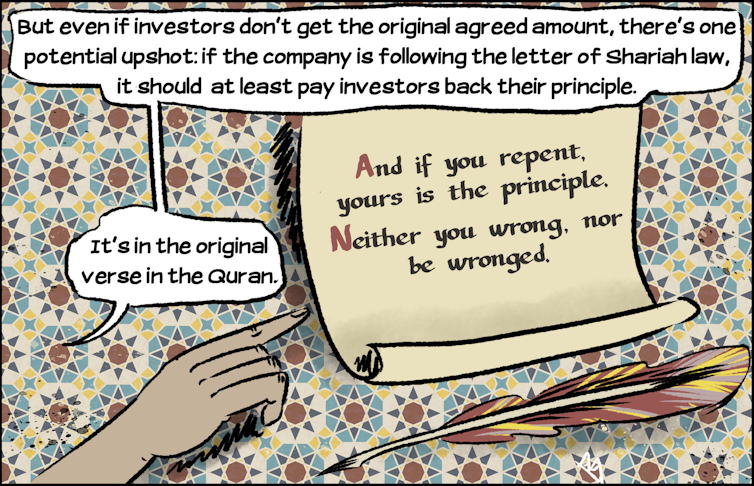

But under Islamic law, interest is explicitly forbidden. In fact, the guidance comes directly from Quran.

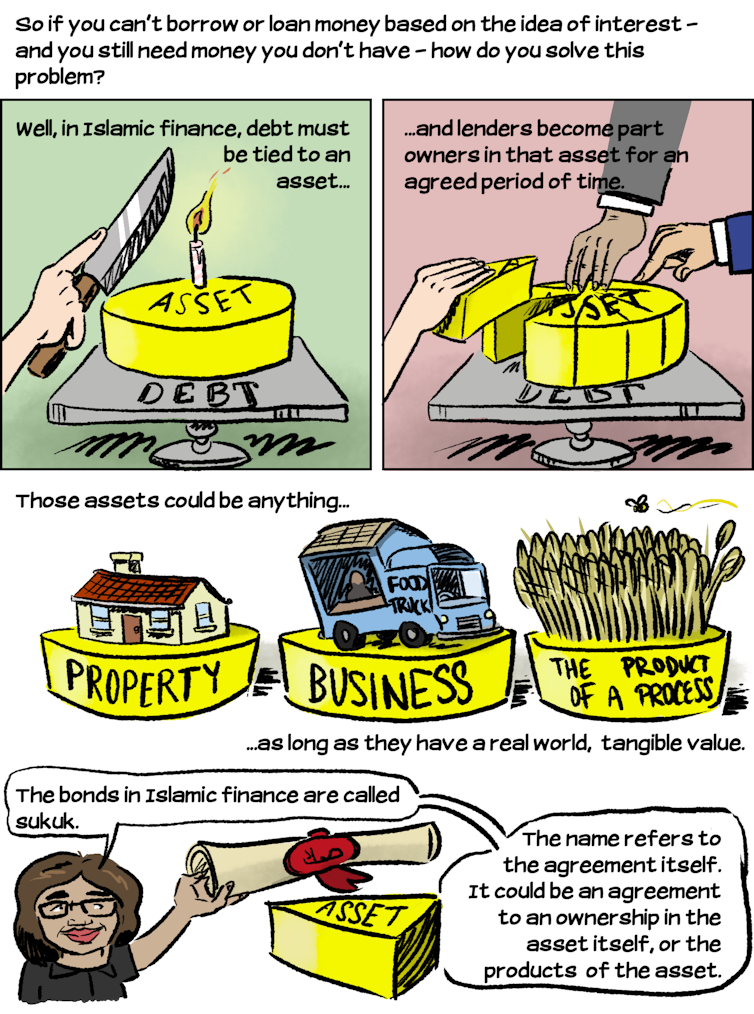

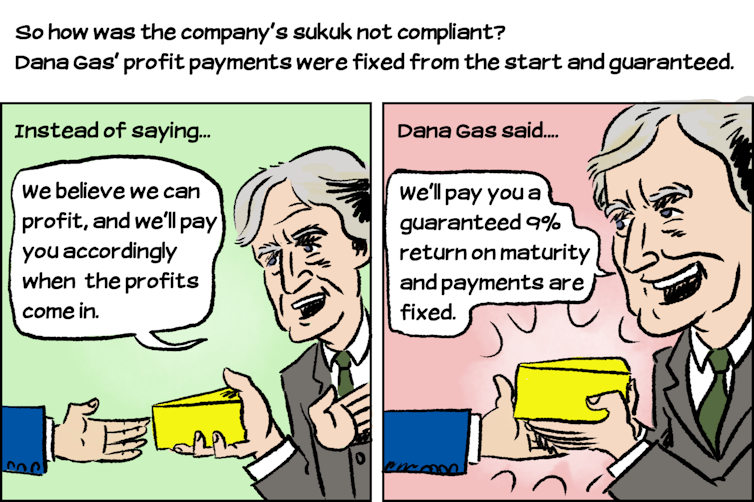

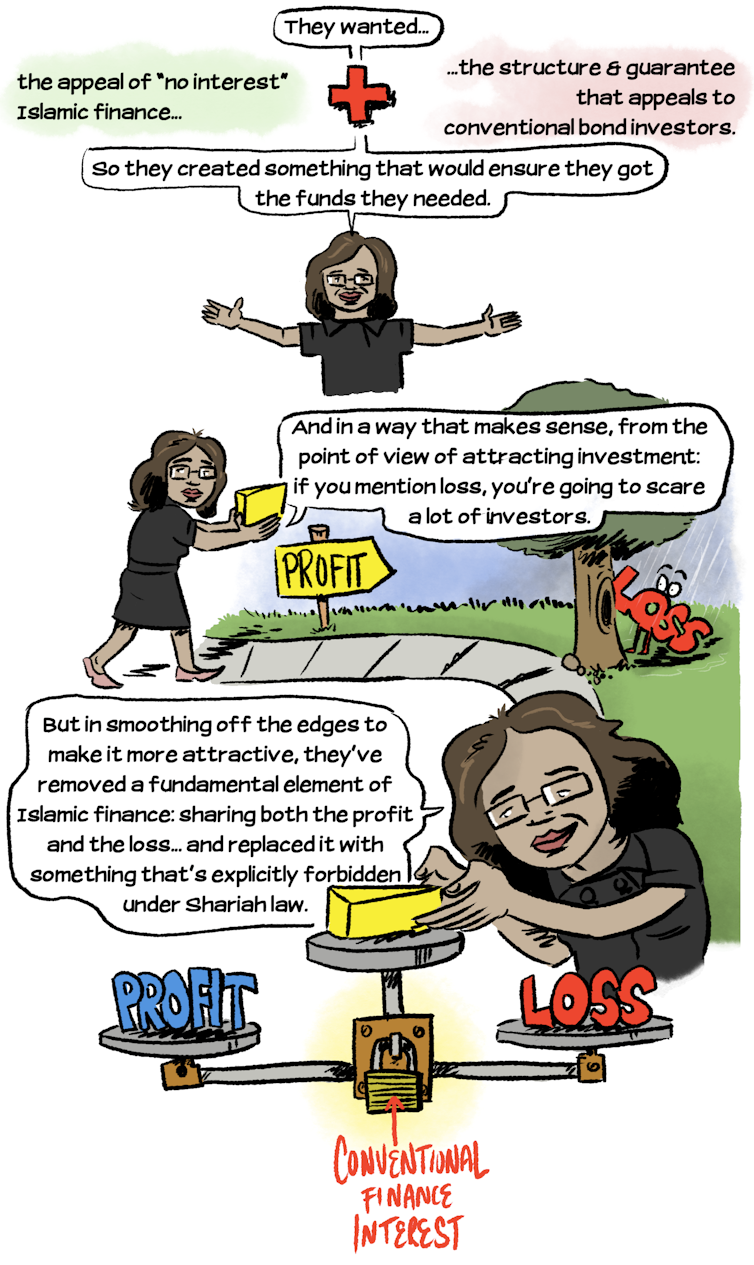

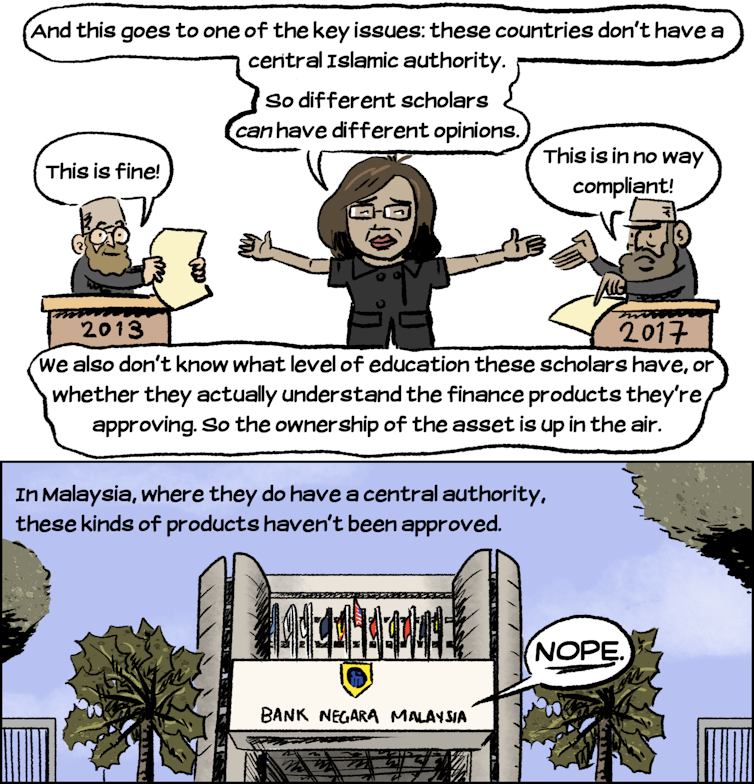

So how do finance, debt and all of the ways we get money in the conventional banking system work if you can’t charge interest?

The University of Queensland’s Mamiza Haq explains.

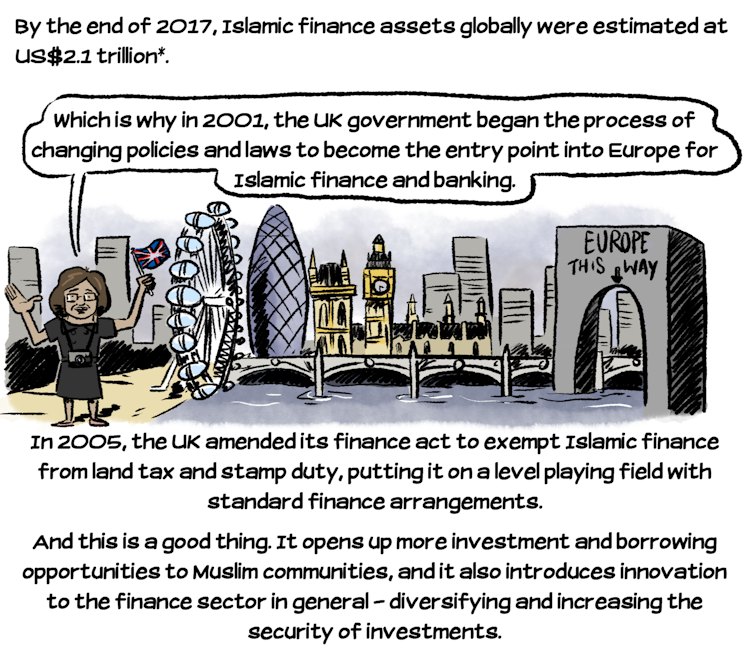

*From S&P Global Ratings – Islamic Finance Outlook 2018 Edition

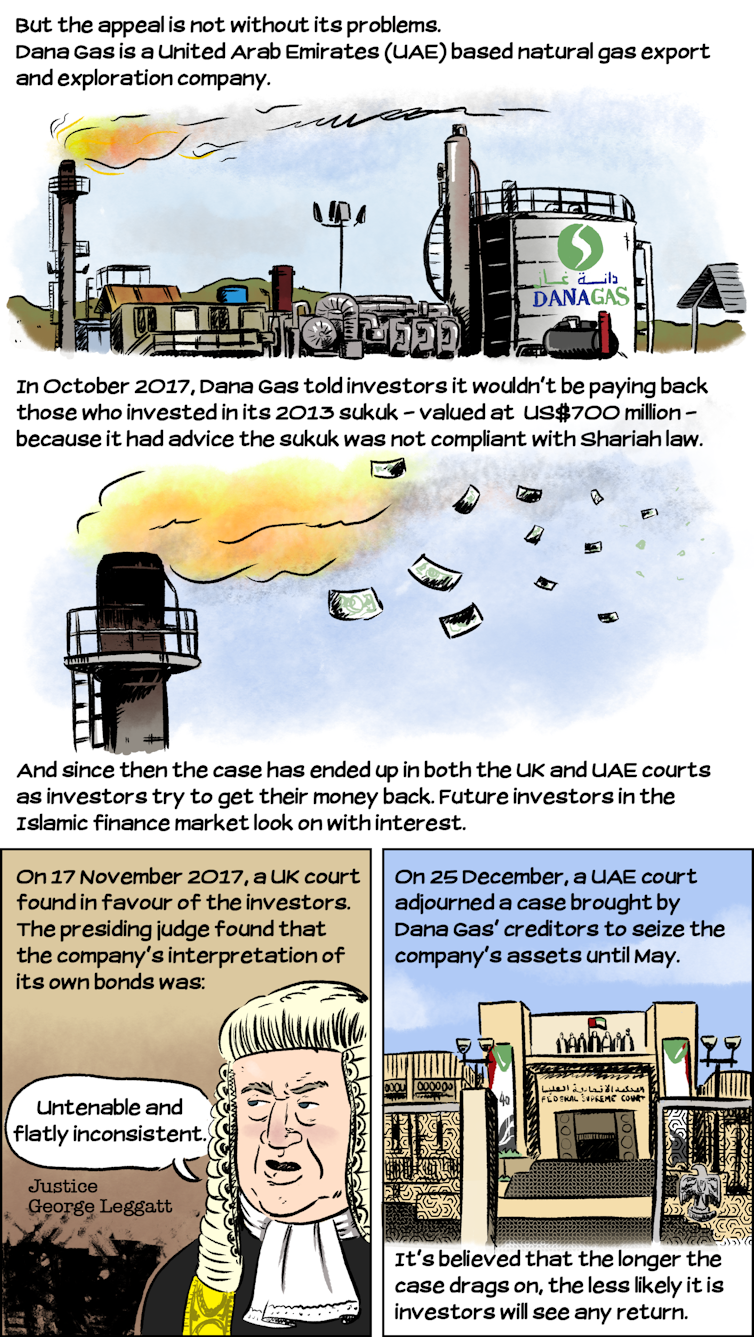

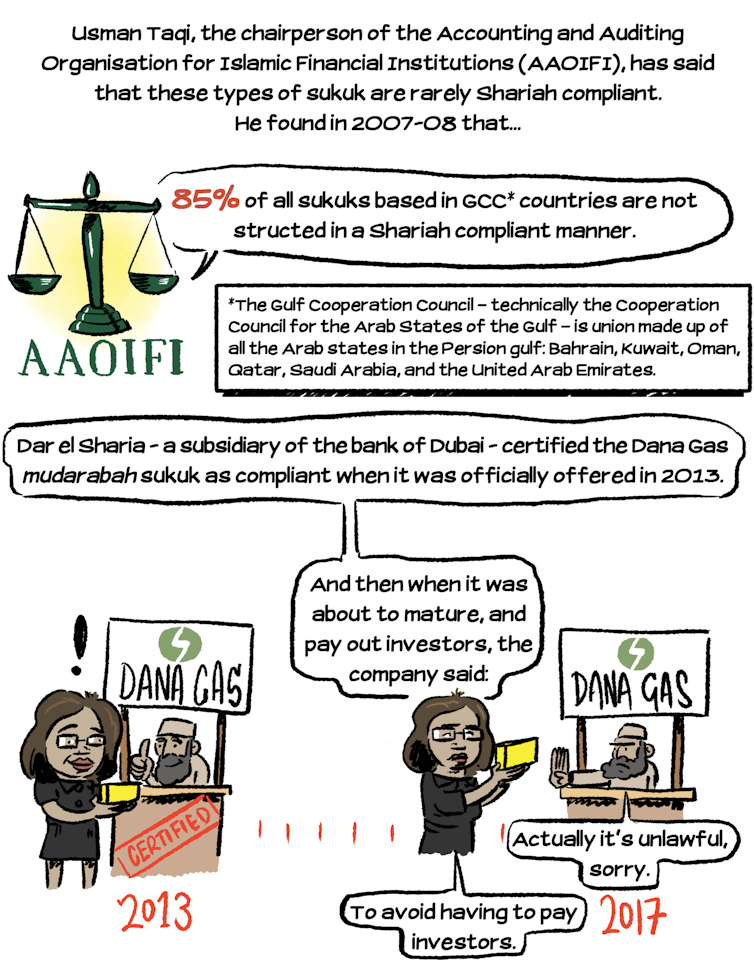

Bloomberg: Dana Gas Sukuk Talks Stall as It Seeks 15% Discount on Buyback

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks