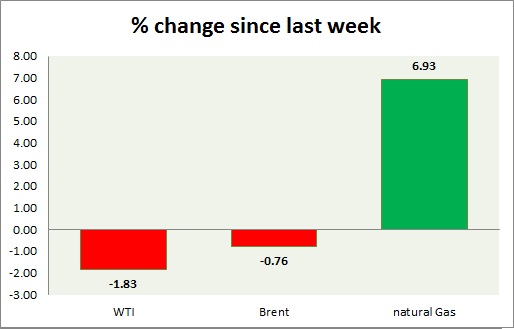

Energy pack is mixed in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil price is moving down despite Middle East tensions as inventories continue to build amid sharply higher production. Broad trend is still bullish. Today’s range - $61.5- $62.4

- WTI is currently trading at $61.7/barrel. Immediate support lies at $60 area and resistance at $65 area.

Oil (Brent) –

- Brent remains elevated over WTI due to higher demand, geopolitical tension and OPEC agreement. The recent disappearance of a Washington Post journalist at Saudi Consulate has triggered an international backlash and the market is pushing prices higher on fear of sanctions on Saudi Arabia. Today’s range - $71.8-73.1

- Brent is trading at $9.8 per barrel premium to WTI.

- Brent is trading at $72/barrel. Immediate support lies at $68 area and resistance at $75 region.

Natural Gas –

- The natural gas price has reached the target $3.47 per MMBtu. The price is currently at $3.48 per MMBtu. Today’s range $3.48-$3.54

- Natural Gas is currently trading at $3.52/MMBtu. Immediate support lies at $3.20 area & resistance at $3.61

|

WTI |

-1.83% |

|

Brent |

-0.76% |

|

Natural Gas |

+6.93% |

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed