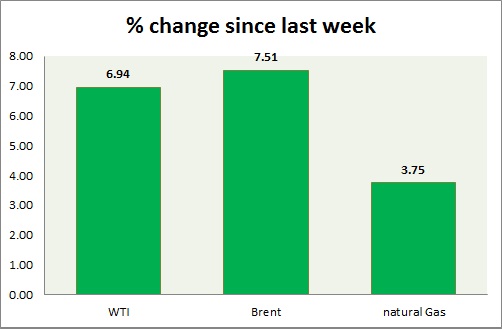

Energy segment gave up all most of the gains in today's trading. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI selloffs continued today after brief pause over FOMC and weak dollar. WTI traded as high as WTI is currently trading at $43.5/ barrel, down nearly 2.5% today. Immediate support lies at 42, 38 and resistance at 45.5, 48.3.

- Oil (Brent) - Brent performance is similar to WTI but mild better. Brent-WTI spread is trading at $ 11.36, support lies at $8 and resistance at $13. Brent has reached the initial target of $53. Might wail for further direction. Brent is trading at $54.83/barrel. Immediate support lies at 53, 50, 47 & resistance at 56, 58.4.

- Natural Gas - Natural gas is trading directionless. It broke above the initial resistance after FOMC but gave up the gain in today's trading. Today's inventory report failed to provide further direction. Inventory 45 billion cubic feet. Natural Gas is currently trading at 2.82/mmbtu. Immediate support lies at 2.65 & resistance at 2.87, 3.02.

|

WTI |

-3.18% |

|

Brent |

0.73% |

|

Natural Gas |

3.68% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?