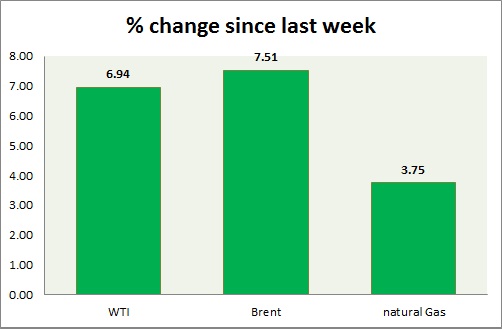

Energy segment's performance is overall positive in today's trading. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI is continuing its post FOMC rally. Weaker dollar improved prospects of US crude amid oversupply. WTI crude is currently trading at 47.8, up 0.75% today. Price target is coming around $51/barrel and $54/barrel. Immediate support lies at 42, 38 and resistance at 48.3, 53.

- Oil (Brent) - Weaker Chinese PMI figure is weighing on Brent price today. Brent-WTI spread is trading at $ 7.7/barrel, broken the support at $8/barrel. Last week it traded close to $11.5/barrel. Brent failed to break above the resistance near $58. Brent is trading at $55.4/barrel. Immediate support lies at 52.5, 48, 45 & resistance at 58.4, 62.

- Natural Gas - Natural gas trading directionless within ranges. Natural Gas is currently trading at 2.79/mmbtu. Immediate support lies at 2.65, 2.55 & resistance at 2.91, 3.02.

|

WTI |

2.43% |

|

Brent |

0.27% |

|

Natural Gas |

0.36% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?