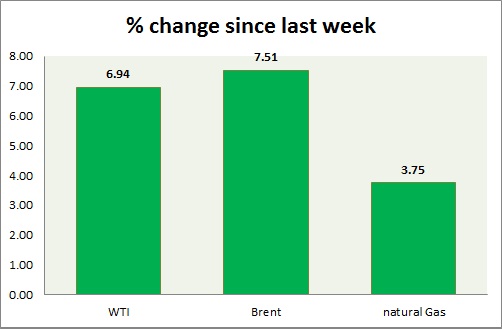

Energy segment is getting hammered by selling as supply across globe continue to rise. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI fell close to -1.2% today, as supply remains large and rigs count fall stabilizes.

- Bulls are struggling after reaching first bullish target of $51 last week.

- Target to the downside is coming around $45.

- WTI is currently trading at $48.03/barrel. Immediate support lies at 47.5-47, 44-43.7 and resistance at 51.7-52.1, 54-54.5, 58.7-59.2.

Oil (Brent) -

- Brent fell dropped more than WTI today as report suggested greater increase in oil production in Middle East. OPEC supply in March rose to 560,000 barrels per day to 30.63 million barrels per day.

- Brent-WTI spread narrowed after since last week, trading at $ 7/barrel, might go further down if Iran deal come out successful and supply continue to rise.

- Brent is trading at $55.2/barrel, down -2.15% today. Bias is downwards. Immediate support lies at 53 & resistance at 59.6-60.

Natural Gas -

- Natural gas broken below support today in early trade, however came back to positive territory over London session.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu.

- Approaching summer is weighing on price. Talks suggest intake for power plants might be higher this year. Upcoming inventory report might provide direction.

- Natural Gas is currently trading at 2.66/mmbtu, up 1.14% today. Immediate support lies at 2.65, 2.55 & resistance at 2.74, 2.91, and 3.02.

|

WTI |

-0.64% |

|

Brent |

-1.52% |

|

Natural Gas |

+0.30% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand