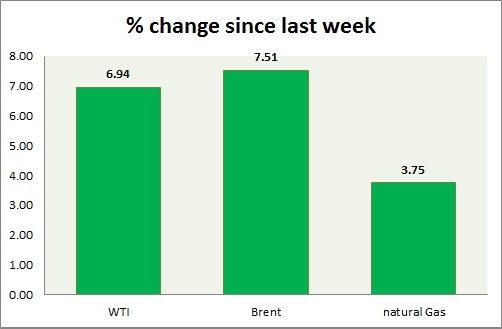

Energy segment is in favor today as dollar weakens. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is up 3.8% today, after Non-farm payroll reported lower job gains of 126,000 compared to median expectation of 245,000. WTI has broken above $50/ barrel.

- Price is looking strong and might test the upper bound of the range.

- Volatility is gaining. Bulls if able to break the resistance zone might push towards $56/ barrel.

- WTI is currently trading at $51.3/barrel. Immediate support lies at $49.8-49.5, $47.5-47 and resistance at $51.7-52.1, $54-54.5, and $58.7-59.2.

Oil (Brent) -

- Brent is doing better than WTI today as Iran deal failed to raise immediate supply concern and increase supply might take years. Market remains skeptical over final deal in June.

- Brent-WTI spread has gained lost grounds today, trading at $ 6.2/barrel. It still remains on weaker side.

- Brent is trading at $57.6/barrel, up 4.5% today. Bias is still downwards, however bulls might push towards $62, should dollar weaken further.

Natural Gas -

- Natural gas was once again pushed back after gains over EIA inventory report that showed unexpected contraction by 18 billion cubic feet.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu. However power companies' shift to natural gas is expected to increase demand.

- Natural Gas is currently trading at 2.65/mmbtu, down 1.5% today. Immediate support lies at 2.55 & resistance at 2.74, 2.81

|

WTI |

+3.88% |

|

Brent |

+4.47% |

|

Natural Gas |

-1.48% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings