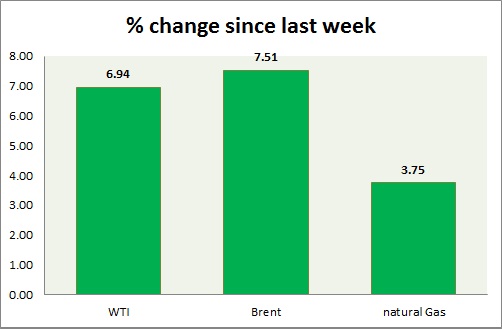

Energy segment is totally in green today as dollar in spite of stronger dollar. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is up today, gained further on spreads. Speculation increases that US production might finally be slowing down. This week's inventory might provide guidance.

- Price is looking strong and might test the upper bound of the range around $54.

- However increased volatility might pose challenge. Crude looks to be on stronger foot hold this month.

- WTI is currently trading at $52.5/barrel. Immediate support lies at $49.8-49.5, $47.5-47 and resistance at $54-54.5, and $58.7-59.2.

Oil (Brent) -

- Brent is doing worse than WTI losing out on spreads. Demand remains high for lighter grade crude.

- Brent-WTI spread has gained lost grounds today, trading at $ 5.8/barrel. It still remains on weaker side and might shrink further.

- Brent is trading at $58.3/barrel. Bigger trend is still downwards, however bulls might push towards $62, should dollar weaken in coming days.

Natural Gas -

- Natural gas is treading water around $2.65 level, awaiting this week's inventory report. Larger increase in inventory would push prices towards lower support area.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu. Demand is expected to remain higher compared as power generating capacities will be using Natural gas more as a fuel.

- Natural Gas is currently trading at 2.68/mmbtu, up 1% today. Immediate support lies at 2.55 & resistance at 2.74, 2.81

|

WTI |

+6.08% |

|

Brent |

+5.60% |

|

Natural Gas |

-0.48% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?