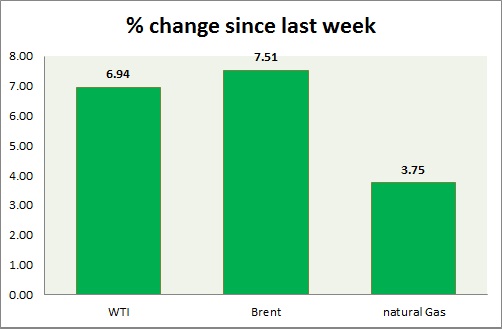

Energy segment's performance is mixed today, oils are up while gas is down. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is facing selling pressure since yesterday, as crude inventory continue to rise in US at record breaking pace.

- Bulls are lacking force after price failed to break sellers around $54. Price might drop lower o test the resolve of the buyers.

- WTI is currently trading at $50.76/barrel, up 0.7% today. Immediate support lies at $49.8-49.5, $47.5-47 and resistance at $54-54.5, and $58.7-59.2.

Oil (Brent) -

- Brent price remain under pressures as reports show supply remains at large from OPEC and Africa.

- Brent-WTI spread has gained ground after US stockpile report, trading at $ 6/barrel. Short trades are advised to book profits. Spread might widen once more.

- Brent is trading at $56.7/barrel. Downtrend still in play. Immediate support lies at $54.5-53 area and resistance at $ 59.4-60.2 region.

Natural Gas -

- Natural gas price dropped sharply this week, now testing the lower bound of the range. Further selloff can't be ruled out, however buy orders are expected to be large around current price at $2.54/mmbtu.

- Price pattern suggests that prices might drop down towards $2.44/mmbtu. According to EIA report published inventory increased by 15 billion cubic feet. Weaker intake over summer might push price lower towards $2.2/mmbtu.

- Natural Gas is currently trading at 2.55/mmbtu, down 2.7% today. Immediate support lies at 2.55 area & resistance at $2.71, 2.81. $2.50 might provide psychological resistance.

|

WTI |

+2.44% |

|

Brent |

+2.70% |

|

Natural Gas |

-5.42% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings