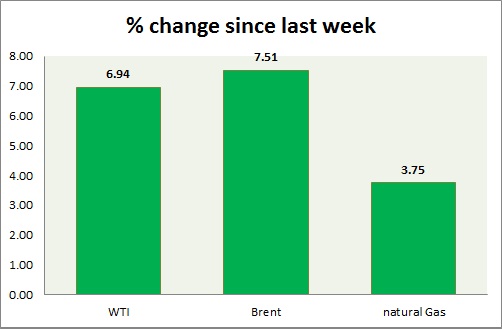

First trading day of the week and energy segment is trading green today, however gas prices remain weak. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is trying to gain grounds after report showed that oil rigs fell further in US. Number of active rigs has fallen to 760.

- Bulls might once again move to test $54-54.5 area. Breakout of the area would push prices higher towards $60 as initial target area.

- WTI is currently trading at $52.9/barrel, up 2.5% today. Immediate support lies at $49.8-49.5, $47.5-47 and resistance at $54-54.5, and $58.9-59.7.

Oil (Brent) -

- Brent is going up along WTI, however bulls are looking to suffer lesser conviction that WTI.

- Brent-WTI moved marginally lower today, trading at $5.95/barrel. Lacking conviction.

- Brent is trading at $58.7/barrel. Downtrend intact. Immediate support lies at $54.5-53 area and resistance at $ 59.4-60.2 region.

Natural Gas -

- Natural gas is the worst performer once again from start of this week. Intraday price has broken below $2.52. -$2.50/mmbtu zone and traded $2.47.

- Price is now trading very close to mentioned target of $2.44/mmbtu. Partial profit bookings are advised around levels. Traders should exercise caution, however price still remains bearish.

- Natural Gas is currently trading at 2.52/mmbtu, up 0.4% today. Immediate support lies at $2.12 area & resistance at $2.60, 2.71.

|

WTI |

+2.30% |

|

Brent |

+1.47% |

|

Natural Gas |

+0.56% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary