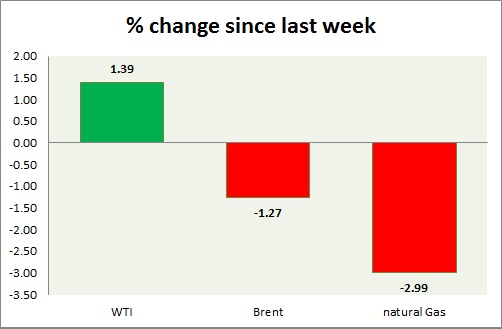

Energy segment performance is mixed so far this week. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is gaining grounds this week, after bulls broke $54 level last week, as suggested earlier WTI might further. $60 looks to be initial target, partial profit booking is recommended and next target is coming around $63-$65 area.

- It might seem bit far-fetched but WTI might as well move towards $70-$75, should dollar index weaken past 96 level. That requires a catalyst for such.

- WTI is currently trading at $57.6/barrel. Immediate support lies at $51.2-50, $47.5-47 and resistance at $58.9-59.7.

Oil (Brent) -

- Brent dropped today and down this week so far as bulls faced resistance. Bulls might continue to test the resistance around $64-$65, while WTI close in on $60 level.

- Brent-WTI spread down further today, currently trading at $5.3/barrel. Bears are might push spread lower, however may remain limited to $2-$3.

- Brent is trading at $62.9/barrel. Immediate support lies at 61.8-61.4, $58-57 area and resistance at $ 64-$65 region.

Natural Gas -

- Natural gas is worst performer this week and might move lower over summer, however it won't be just one way ride as volatilities and swings would keep short trading environment tougher.

- Price target is coming close to $2.15/mmbtu.

- Natural Gas is currently trading at 2.56/mmbtu. Immediate support lies at $2.12 area & resistance at $2.71.

|

WTI |

+1.39% |

|

Brent |

-1.27% |

|

Natural Gas |

-2.99% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate