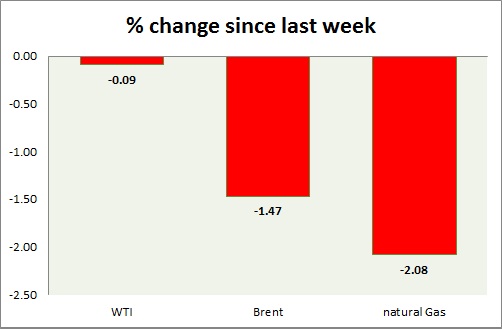

Energy segment performance is mixed so far this week. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI recovered from the loss after EIA data was released. Saudi's halt of military actions in Yemen pushed prices lower since last night. $60 looks to be initial target, partial profit booking is recommended and next target is coming around $63-$65 area.

- It might seem bit far-fetched but WTI might as well move towards $70-$75, should dollar index weaken past 96 level. That requires a catalyst for such.

- EIA data indicated, crude stocks rose 5.31 million barrels last week.

- WTI is currently trading at $56.8/barrel. Immediate support lies at $51.2-50, $47.5-47 and resistance at $58.9-59.7.

Oil (Brent) -

- Brent gained today, along with WTI, recovering from Saudi actions in Yemen. However bulls are lacking strength. Brent made high around $63 and low around $61.3

- Brent-WTI spread moved up today, currently trading at $6/barrel. Bears might still push spread lower. However both lacking clear conviction

- Brent is trading at $62.9/barrel. Immediate support lies at 61.8-61.4, $58-57 area and resistance at $ 64-$65 region.

Natural Gas -

- Natural gas gained today, however price might move lower over summer. Higher volatilities will be a pain for short term traders.

- Price target is coming close to $2.15/mmbtu. However this won't be one way ride. Resistance around $2.84 remains crucial.

- Natural Gas is currently trading at 2.59/mmbtu. Immediate support lies at $2.12 area & resistance at $2.71.

|

WTI |

+-0.09% |

|

Brent |

-1.47% |

|

Natural Gas |

-2.08% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate