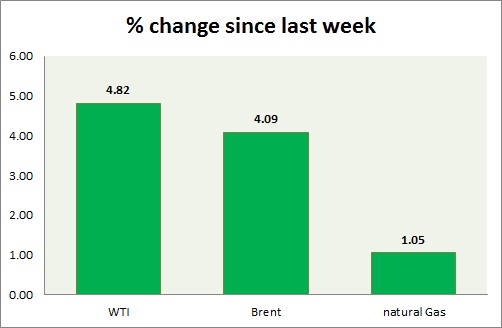

Energy segment is trading in green today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- Weaker dollar and drop in US crude stock pile provided cues to bulls that have pushed prices higher.

- EIA stocks dropped -3.9 million barrels last week. Bulls are now targeting $64-$65 area and might move to $70 should dollar weaken further.

- WTI is currently trading at $62/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $58.9-59.7, $64-$65. Partial booking is suggested at around second target of $63-$65 area.

Oil (Brent) -

- Brent rose along WTI as weaker dollar provided the necessary support.

- Brent-WTI spread is trading flat today, currently trading at $7.2/barrel. Brent might be targeting $69.6-$70 level as initial target. Lower stockpile failed to push spread lower, signaling that it might be taking cues from elsewhere.

- Brent is trading at $69.2/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region. Traders should exercise caution as first target is almost reached and payroll data is due on Friday.

Natural Gas -

- Bulls are struggling to break free of key resistance, tomorrow's inventory report could provide cues needed followed by payroll report on Friday.

- Bulls need to break above $2.85-$2.9 area to diminish downside bias significantly.

- Natural Gas is currently trading at 2.80/mmbtu. Immediate support lies at $2.44 area & resistance at $2.86.

|

WTI |

+4.82% |

|

Brent |

+4.09% |

|

Natural Gas |

+1.05% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings