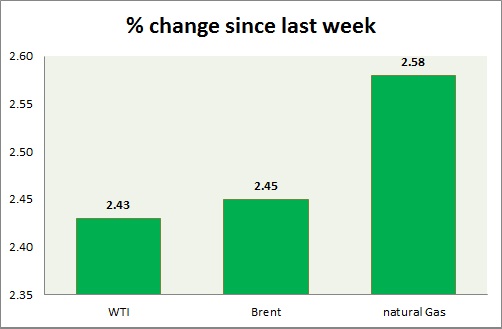

Energy segment is trading showing strength, however sellers continue to push crude prices. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI gained amid weaker dollar, however sellers are strongly defending the last high made around $62. Crude has failed to break above $62, in spite of fall in inventory.

- WTI carved bearish doji in weekly chart and very bearish grave stone doji in daily chart.. Further downside remains open if doji high is not taken out. RSI is also around 50 level resistance. However weak dollar would keep feeding the bulls.

- EIA weekly inventory dropped by -2.2 million barrels.

- WTI is currently trading at $60.8/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide interim support.

Oil (Brent) -

- Brent is a better performer than WTI today, however facing similar selling pressure.

- Brent-WTI spread gained around 40 cents, currently trading at $6.3/barrel. Further rise seems likely in favor of Brent.

- Brent is trading at $67.1/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas gained from weaker dollar and remain as best performer today. Further gain is likely.

- $3 is to pose psychological resistance.

- This year there could be higher intake for natural gas, as natural gas driven power plants rises in numbers in US.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at 2.94/mmbtu. Immediate support lies at $2.72, $2.65, $2.44 area & resistance at $3.06.

|

WTI |

+2.43% |

|

Brent |

+2.45% |

|

Natural Gas |

+2.58% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings