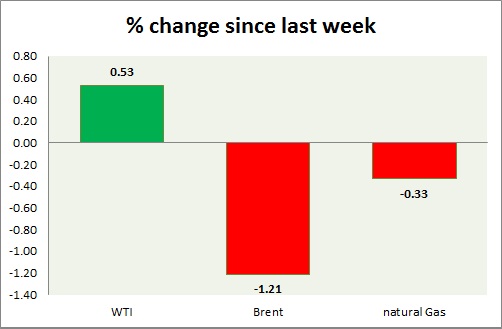

Energy segment advanced today, however giving up gains fast. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI gained today in early Asian session as Middle East tension resumed and dollar weakened. However giving up gains after making high at $61.7 area.

- WTI carved bearish doji in weekly chart and very bearish grave stone doji in daily chart. Further downside remains open if doji high is not taken out. RSI is also around 50 level resistance.

- WTI is currently trading at $60.3/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide interim support.

Oil (Brent) -

- Brent is losing grounds faster than WTI, after carving high at $67.91

- Brent-WTI spread lost around 90 cents, currently trading at $5.9/barrel.

- Brent is trading at $66.08/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas is consolidating around $3 area, however further rise remain in card.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at $3/mmbtu. Immediate support lies at $2.72 area & resistance at $3.06.

|

WTI |

+0.53% |

|

Brent |

-1.21% |

|

Natural Gas |

-0.33% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate