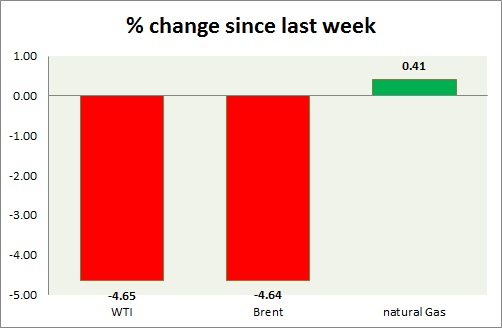

Energy pack is trading in consolidation with downside bias today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI is down today after gains yesterday. Today's range $38.5-39.8

- EIA report showed drop in inventory by 5.5 million barrels.

- WTI is currently trading at $39/barrel. Immediate support lies at $35 area and resistance at $43 area.

Oil (Brent) -

- Brent dropped along with WTI, however volatility remains relatively low. Today's range - $43.8-42.8.

- Brent-WTI spread dropped to $4.2/barrel.

- Brent is trading at $43.2/barrel. Immediate support lies at $40 area and resistance at $47 region.

Natural Gas -

- Natural gas finding resistance around $2.7/mmbtu and likely to drop further. Today's range $2.72-2.67.

- Price likely to drop to $2.35/mmbtu, since support cleared.

- Natural Gas is currently trading at $2.69/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.75, $2.95, $3.04, $3.32.

|

WTI |

-4.65% |

|

Brent |

-4.64% |

|

Natural Gas |

+0.41% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand