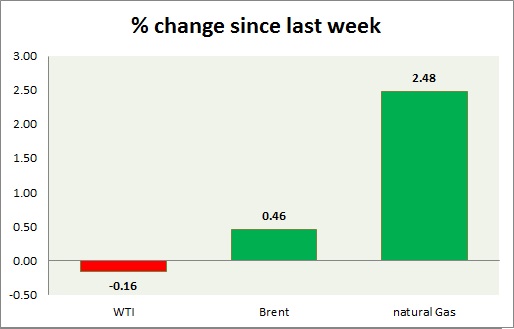

Energy pack is down in today’s trading. Weekly performance at a glance in chart & table,

Oil (WTI) –

- Oil is down on reports that OPEC supplies on the rise despite Saudi Arabia’s pledge to reduce exports. Today’s range $49.7-48.9

- Active call – Buy targeting $56 per barrel

- WTI is currently trading at $49.6/barrel. Immediate support lies at $45 area and resistance at $52 area.

Oil (Brent) –

- Brent is a much better performer than WTI this week. Today’s range - $51.8-52.7

- Brent is trading at $3 per barrel premium to WTI. Likely to widen further in the medium term.

- Brent is trading at $52.6/barrel. Immediate support lies at $48 area and resistance at $54 region.

Natural Gas –

- Natural gas is trying to form a base around $2.75 area. The best performer of the week. Today’s range $2.8-2.86

- Active Call -Bear trend would push it towards $2.69 per MMBtu

- Natural Gas is currently trading at $2.85/MMBtu. Immediate support lies at $2.75 area & resistance at and $2.96

|

WTI |

-0.16% |

|

Brent |

+0.46% |

|

Natural Gas |

+2.48% |

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed