Energy segment continues to move sideways as further queues over supply and demands yet to arrive.

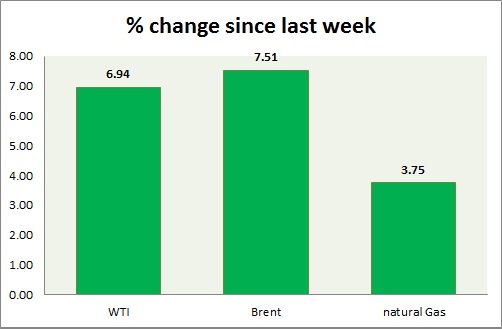

Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI gaining ground in today's trading however experiencing downside pressure over $ 50 /barrel. Recent information suggests that rig count is further down and fallen below 1000, near 40% drop from its recent peak. WTI is currently trading at $50.5/ barrel. Immediate support lies at 48 and resistance at 54.

- Oil (Brent) - Brent lost ground over the supply concern. Recent information suggests that resolution might come over Iran over the nuclear talk which would further increase the supply in the market. Brent-WTI spread narrowed further and trading just above $9, down from $13 last week. Brent is trading at $59.2/barrel. Immediate support lies at 58 & resistance at 63.

- Natural Gas - Natural gas, lost volatility which might be comeback once again over the inventory report. Natural gas is currently trading at 2.72/mmbtu. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

1.69% |

|

Brent |

-0.67% |

|

Natural Gas |

-4.23% |