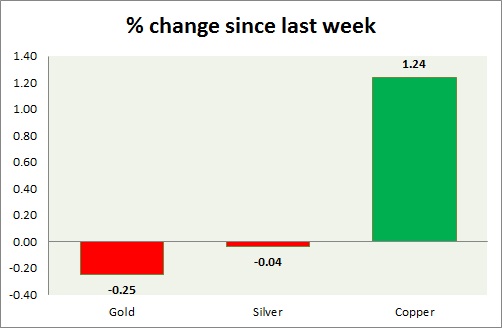

Metals' performance are mixed in today's trading, precious pack is down while industrial remains up. Performance this week at a glance in chart & table -

Gold -

- Gold marginally lost grounds today, however maintaining well amid stronger dollar. Price is treading water near $1200 level.

- Gold has taken support around $1193 level, however sellers remain at large.

- Gold is currently trading at $1195, down 0.5% today. Immediate support lies at $1193, $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver turned into best performer to worst performer this week, so far. Volatility remains high this week. Stronger dollar post FOMC pushing price lower.

- Silver has broken below $16.5 level and price was pushed towards $16.1, before bouncing back a few.

- Mint ratio jumped 1.3% today, currently at 73.8. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.2/troy ounce, down 1.7% today. Downtrend remains intact and price might plunge lower. Support lies at 15.42,14 & resistance at 17.5-17.7.

Copper -

- Copper is treading water around $2.74 area today. Bids are places around $2.71 and offers around $2.765 intraday.

- Current move suggest bears are in full control around $2.8-2.92 area. Downside target is coming around $2.52, with a stop of $2.84, upside can still be played with target around $3.1 with stop of $ 2.45.

- Bearish inverted hammer remains in play in weekly chart.

- Copper is currently trading at $2.74/pound. Immediate support lies at 2.59 & resistance at 2.83, 2.93, and 3.07.

|

Gold |

-0.42% |

|

Silver |

-2.94% |

|

Copper |

0.33% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary