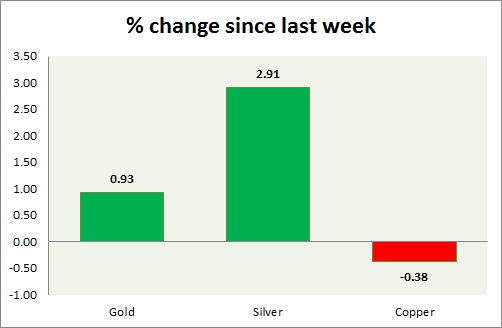

Precious pack remains worst performer, in spite of weaker dollar. Performance this week at a glance in chart & table -

Gold -

- Gold bears were being halted at $1178 support and whereas bulls are struggling above $1200 area.

- This week's NFP report would provide further guidance. Bears are likely to break below should $1209 holds.

- Gold is currently trading at $1189/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1209, $1224 and $1236-1240 area.

Silver -

- Silver is doing better than gold, as bulls took support around $15.5 area. However bears still remain at large.

- Mint ratio is down -1.84%, currently at 71.5. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.6/troy ounce, up 2.9% since last week. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper bulls have broken the resolve of bears, breaking above $2.85 resistance last week, amid weaker dollar.

- Bulls might be targeting $3.16 area.

- Copper is currently trading at $2.92/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+0.93% |

|

Silver |

+2.91% |

|

Copper |

-0.38% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand