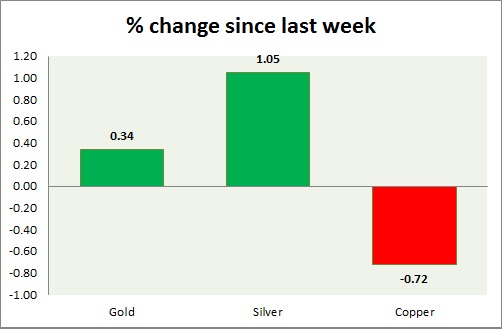

Metals failed to gain today, in spite of weaker dollar. Performance this week at a glance in chart & table -

Gold -

- Gold fell towards $1178 support after bulls failed to break $1200 yesterday, gold might hover around here and wait for the NFP to break level. $1178 level looks fragile.

- Gold is currently trading at $1182/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1209, $1224 and $1236-1240 area.

Silver -

- Silver bulls failed to break key resistance down about 30 cents. Silver made high at $16.53 and low at $16.17.

- Mint ratio is up +0.60%, currently at 72.5. Mint ratio and precious metal prices are inversely related more often than not. Mint ratio is indicating to further downside.

- Silver is currently trading at $16.3/troy ounce. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper dropped further as bulls struggle to break free of $2.95 resistance. Breakout still seems likely as bearish bias has diminished significantly over last week's move. Tomorrow's NFP is key for further movement.

- Bulls might be targeting $3.1-3.16 area if breakout is successful tomorrow. However $3 might provide psychological resistance.

- Copper is currently trading at $2.91/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+0.34% |

|

Silver |

+1.05% |

|

Copper |

-0.72% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary