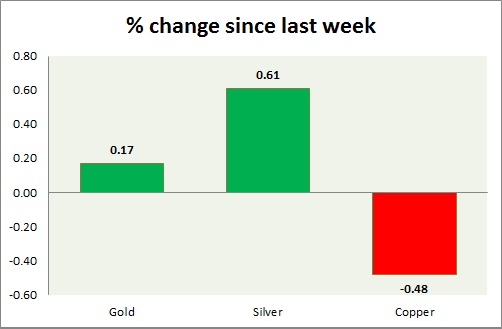

Metals are continuing small range lacks strength. Performance this week at a glance in chart & table -

Gold -

- Gold last week has taken support of $1178 once more over NFP report release. However bulls are lacking conviction to push gold on the upside. As of now Downside remains more likely with stop around $1200-$1209.

- Gold is currently trading at $1190/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1209, $1224 and $1236-1240 area.

Silver -

- Silver is once again testing resistance around $16.6, breaking it won't turn bias on bullish side, however it would temporarily subside bearish pressure.

- Mint ratio is down -0.1%, currently at 72.05. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.5/troy ounce. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper bulls failed to take cues from NFP report on Friday and Chinese rate cut over the weekend. Copper might go for larger correction before it breaks above level.

- Bulls might be targeting $3.1-3.16 area if breakout is successful. However $3 might provide psychological resistance.

- Copper is currently trading at $2.90/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+0.17% |

|

Silver |

+0.61% |

|

Copper |

-0.48% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?