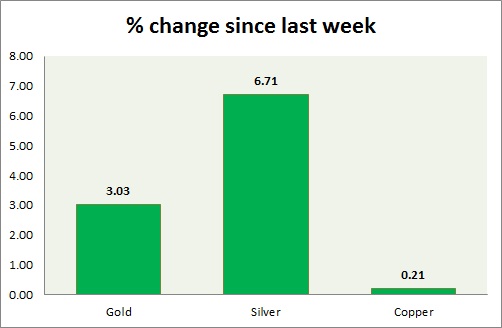

Metals pack are trading in green today. Performance this week at a glance in chart & table -

Gold -

- Gold is back again at $1224 resistance area, after failing to close above it yesterday. Clear Break will lead gold towards $1252

- Gold is currently trading at $1224/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver is back again testing resistance area of $17.5-$17.7 after failure yesterday, clear break would push silver higher around $18.5 as first target.

- Mint ratio is down -0.09% today, currently at 69.7. Mint ratio and precious metal prices are inversely related more often than not. Ratio is at key support while silver and gold is at key resistance.

- Silver is currently trading at $17.5/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- While other metals advance copper is failing to break above key resistance around $2.95.

- Bulls might be targeting $3.1-3.16 area if breakout is successful. However $3 might provide psychological resistance.

- Copper is currently trading at $2.92/pound, immediate support lies at $2.86, $2.76 & resistance at $2.95, $3.07.

|

Gold |

+3.03% |

|

Silver |

+6.71% |

|

Copper |

+0.21% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate