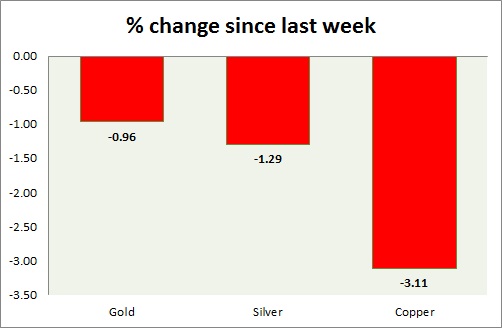

Metal pack are mostly flat today, after yesterday's massive sell off. Performance this week at a glance in chart & table -

Gold -

- Bulls are struggling to pose a comeback. Upside still remains open, larger correction might occur in immediate term. FOMC minutes is in focus. Upside target is $1252.

- Gold is currently trading at $1212/troy ounce. Immediate support lies at $1208, $1178 and resistance at $1236-1240 area.

Silver -

- Silver is better performer today. Price likely to pose another challenge to $17.5-17.7 resistance area

- Mint ratio is down -0.55% today, currently at 70.2. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $17.25/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Strong dollar made bears active in dollar.

- Short term sell is recommended since $2.95 held strong.

- Copper is currently trading at $2.83/pound, immediate support lies at $2.76 & resistance at $2.95, $3.07. $2.89 would provide interim resistance.

|

Gold |

-0.96% |

|

Silver |

-1.29% |

|

Copper |

-3.11% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate