The final reading for Q1 GDP was a bit better than expected, but we continue to worry about the sustained negative surprises in inflation. The Gross Domestic Product (GDP) in Singapore expanded an annualized 3.20% in Q1 of 2015 over the previous quarter which was better than forecasted figure (1.8%).

Yesterday, core inflation came in at 0.4% YoY while consensus was 0.7%, the lowest since early 2010. Despite passing on the opportunity to ease monetary conditions in April.

While Industrial Production was decreased 5.80% in April of 2015 over the previous month.

We believe the MAS will be forced to adjust the NEER policy band by the October MPS.

Although we are bullish on this pair, we would like to play it safe. Hence, BCS are recommended.

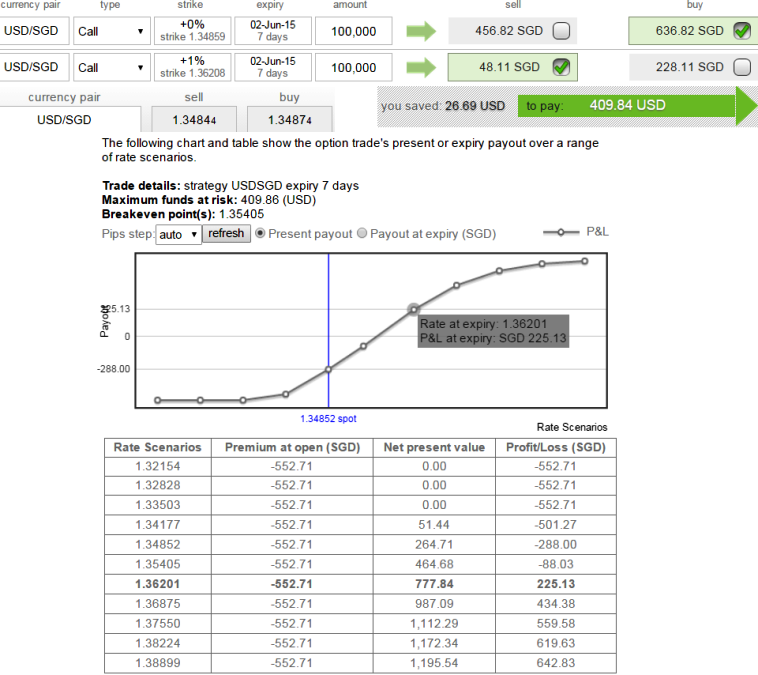

Currency Option Strategy: Bull call spread of USD/SGD

Overview: Bullish

Although this strategy seems a bit expensive but still profitable scheme as the NPV of this strategy does not suggest right option premium. Risky traders can deploy this for potential upswings on this pair.

Buy a Call (either ATM or ITM) and Sell another Call (OTM) with a higher Strike Price with the same expiration date for a net premium payable.

This is worth using a Bull Call Spread over a long call as the bull momentum are triggered and taken over by many bulls which leads the cost of the long naked call too expensive.

Credit from short call reduces the cost of long call.

Concerns over Inflation, IP numbers hinders SGD; NPV of BCS costlier

Tuesday, May 26, 2015 1:06 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?