The Bank of Canada in October held interest rates, but painted a gloomy picture of the Canadian economy. The BOC noted that weak oil prices have had a negative impact on the export sector and hurt economic growth. In its monetary policy report the c.bank said that the Canadian economy will grow just 2 per cent in 2016 and 2.5 per cent in 2017, lower than the previous forecasts of 2.3 per cent and 2.6 per cent.

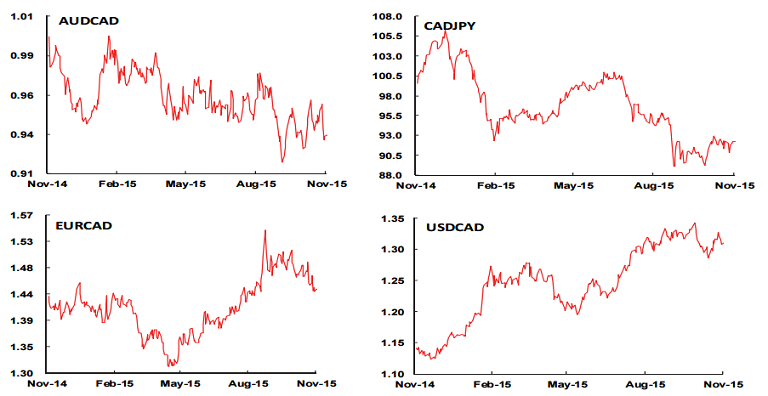

Tanking commodities has seen the Canadian economy decouple from the US economic locomotive. For almost two years, Canada's single most important industry, oil and gas production, has been devastated by the glut of petroleum products on world markets. Under these circumstances, policymakers will likely prefer to see the CAD stay relatively soft. The BoC has frequently stressed the "shock-absorbing" role of a flexible exchange rate in helping the Canadian economy cope with exogenous shocks.

"The persistent low level of oil prices means that capital spending in the oil patch is likely to decline again in 2016. That is a key headwind to growth in the overall economy, which we expect to remain quite modest over the medium term," said economist Leslie Preston of Toronto-Dominion Bank.

From a chart perspective, there is little doubt that the mid-year rally in USD/CAD has lost some momentum. Consolidation is the order of the day, and could extend for some time. USD/CAD edged higher to 1.3278 last week but lost momentum and retreated. CAD will retain a softer tone as investors re-price the bottoming out of the bearish commodity market cycle in the context of accommodative monetary policy. Interest rate differentials and low oil prices will move against the Canadian dollar as US interest rates rise.

"Assuming the Fed reaches lift-off before year-end, we think a combination of higher US rates (and wider yield spreads versus the CAD) and low oil prices will lift USD/CAD to just below 1.40 in H2 2016", notes Scotiabank in a research report.

However, the Canadian economy has started to recover from the contraction in the first half of 2015, led by exports - particularly in the transportation and aerospace industries - residential investment, and consumer spending. Despite the first half contraction, the labour market has continued to add jobs at a moderate pace, with positive momentum in the service sector and construction activity. Vehicle sales are at record highs, and auto production is picking up after an extended period of retooling in the first half of the year.

"We look for seasonal patterns to help out; the USD usually does well against the CAD late in Q4 and early in H1 of the following year. From here, gains above 1.3250 will be positive for the USD and we expect solid USD support on weakness to the 1.28 area", adds Scotiabank.

In today's trade, the pair has edged above the 1.31 handle, and currently is trading at 1.3105, bias is on the downside. Failure above 1.3218 (61.8% retrace of the 1.2457-1.2832 fall) on Oct 29th and daily close back below daily cloud yesterday is hurting bulls.

Consolidation in USD/CAD to extend further, higher U.S rates, lower oil prices to weigh

Tuesday, November 3, 2015 11:28 AM UTC

Editor's Picks

- Market Data

Most Popular

9

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty