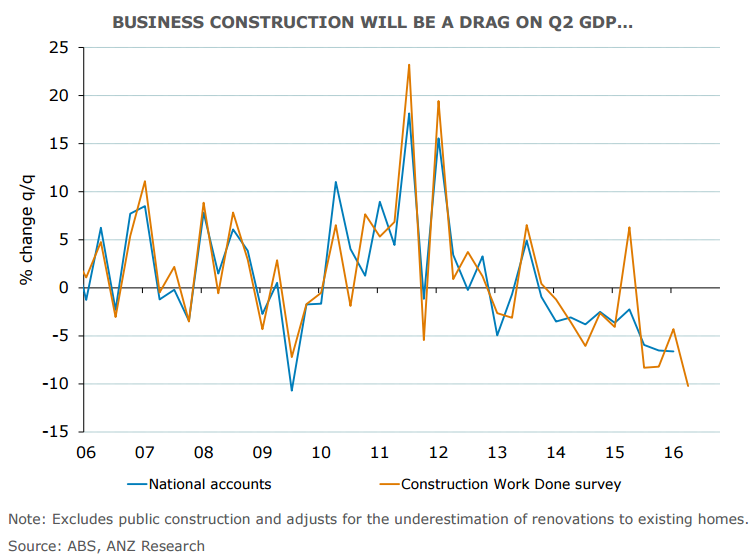

Australia's total construction work done fell sharply in Q2. Data released by the Australian Bureau of Statistics on Wednesday showed that the total value of construction work completed in Australia fell 3.7 percent in the second quarter from the first quarter to A$47.42 billion. It was the largest q/q fall since Q3 2015, and was 11 perent lower than a year ago.

Steep fall in mining-related engineering construction likely drove the fall in total construction. Private engineering construction fell by 14 percent in Q2, which was the largest fall since the early 1980s recession. Australia's economy is experiencing the maximum drag from the unwinding of the record boom in resource-sector investment.

Residential investment posted another solid gain, but the weakness in engineering likely offset the gains. Residential construction rose solidly in Q2, while non-residential building remained little changed. Home building was up a healthy 9.7 percent at A$17 billion during the quarter, benefiting from historically low mortgage rates and brisk population growth.

Government investment is finally witnessing the long-awaited recovery as spending on public works expanded at a double-digit pace in Q2 to hit the highest in more than two years. Total public construction rose by 5 percent in Q2 with growth broad-based. Public housing, non-residential, and engineering construction all posted solid increases. However, it is to be noted that public construction data do not feed into GDP.

The Reserve bank of Australia cut its benchmark interest rates in May and August taking them to an all-time low of 1.5 percent. The climb in residential construction will reassure the central bank that monetary stimulus is working. Strong demand from housing activity has helped to ensure a smooth and broadly steady transition from unwinding of the record boom in resource-sector investment.

"Falling construction work would probably lop 0.5 percent off second quarter GDP, having already subtracted 0.1 percent from the first quarter," notes ANZ economist Daniel Gradwell in a report.

AUD/USD was trading 0.09 percent higher on the day at around 0.7620 at 10:30 GMT. Upside in the pair remains capped by 20-day MA at 0.7630. Major trendline support is seen at 0.7545. Near-term trend is higher, weakness only below 0.7545.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off