- Norway's oil & gas investments have dropped.

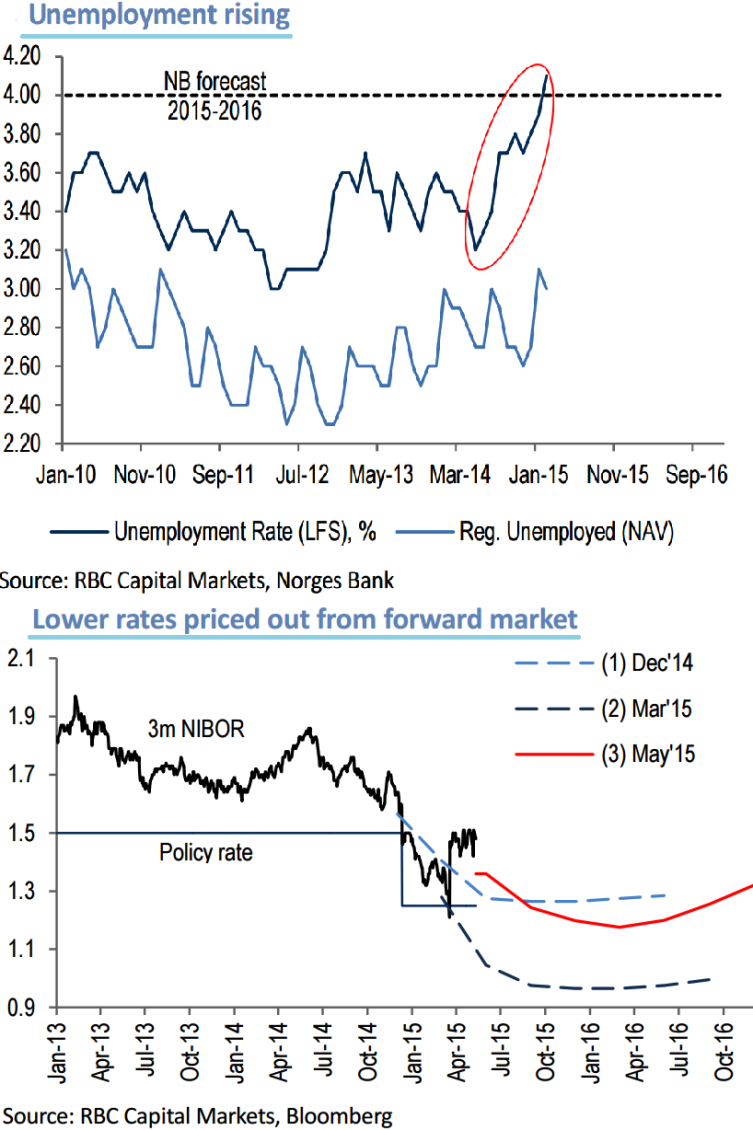

- Unemployment has increased ever since oil prices began their decline.

- GDP growth is softer but not far off trend pace.

- CPI remains close to the consensus.

- Rebound in oil prices pick up NOK.

- Lower rates priced out from forward market.

Lower interest rates and FX Forwards Advantages:

With policy rate at 1.50% last year there was plenty of room for markets to price in aggressive easing as oil prices fell from USD110/bbl to USD45/bbl.

That the Norges Bank will likely cut rates in June should see mild NOK weakness over the short term.

Past that, we suppose NOK can grind higher, with interest rates at 1.25%, NOK is a relative high-yielder in G10 that should keep the currency supported.

With the Norwegian economy proving resilient so far, as shown in the figure much of that aggressive easing has been priced out, and lifting NOK in the process. Also observe when the interests declined in April Forward volumes are spiking up.

We see in a long run EUR/NOK briefly rising to 8.70 in June on the verge of a likely rate cut by the Norges Bank. Past that, we think the pair will gradually grind lower to 8.50 by year end 2015, with a view of its extending further if oil prices continue their rebound higher.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate