We have witnessed constructive developments in the cryptocurrency derivatives market,

CME has come up with the Bitcoin futures which are cash settled. Various OTC players like Binance, BitMEX & OKEx, are well equipped in crypto-derivatives markets with perpetual swap derivatives products. While FTX is lined up for options trading facility for Bitcoin (BTC). Yesterday, the CEO of FTX, Sam Bankman-Fried announced that options were listed on their trading platform.

Amidst such developments, we have noted the gradual maturing of the cryptocurrency space as the influence of institutional investors has grown in the aftermath of the listing of bitcoin futures since Dec 2017. Indeed, a few months ago we noted that the true level of institutional participation was likely greater than widely used trading volume figures implied, as a number of sources suggested.

But CME is no far from this race, they have also scheduled to unveil the options trading mechanism for bitcoin, likely to commence from January 13, 2020.

The new cryptocurrency start-up, Bakkt established by the Intercontinental Exchange (ICE), has already launched bitcoin options, futures contracts with physical delivery as well as cash-settled facilities.

Since CME is set to roll out regulated options on bitcoin futures, it represents the growth of the listed options market. The contracts that are settled into futures, carries luring factors for the new investors to the market. This brings in a hedging mechanism for miners ahead of the bitcoin block subsidy halving. As a result, huge turbulence in the underlying bitcoin price would be expected.

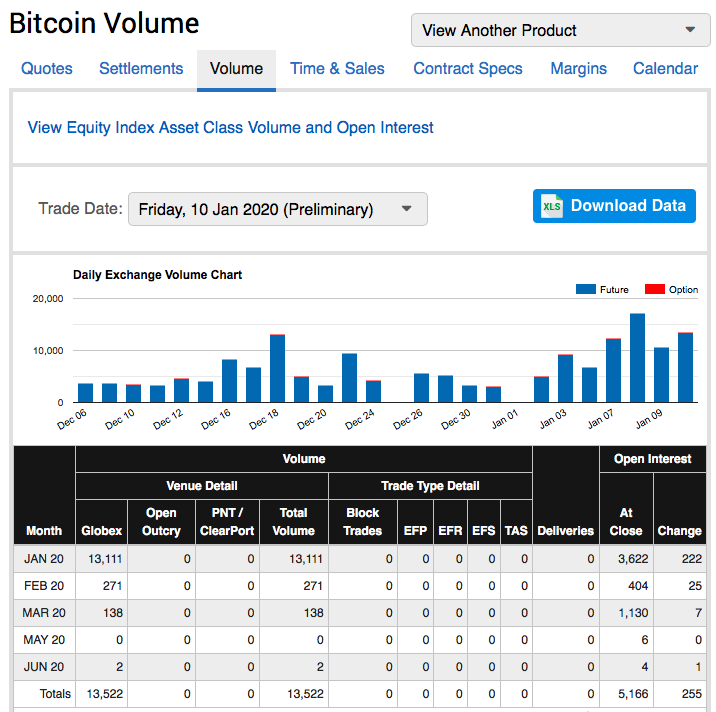

Hence, we are positioned with the prudent longs in CME BTC Futures of January deliveries in our previous write-up on both hedging and trading grounds for targets up to $8,500 level (advocated when spot reference: $7,305). The underlying price of bitcoin (BTCUSD at Coinbase) has reclaimed up to $8.4k levels in the recent past, we squared-off these trade positions by booking profits. During such bullish price action, one can easily make out that there’s been huge volumes and open interests in CME January contracts (refer above chart).

Currently, the pair is trading at $8,070 levels. On hedging grounds, maintain the same longs as we could foresee further upside risks. Courtesy: CME

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  BTC Bombs Higher Despite Iran Conflict: Hits $69K+ – Buy the Dip at $67K for $80K Glory?

BTC Bombs Higher Despite Iran Conflict: Hits $69K+ – Buy the Dip at $67K for $80K Glory?  ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500

ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed