RBC Capital Markets notes:

1 - 3 Month Outlook - A deeper crisis in Greece

Greece's July 5 referendum led to overwhelming support for "No" though it is still unclear what No actually means. With the second bailout having expired, Greece now needs to negotiate a third programme from scratch in order to access funding and reopen its banks; the alternative is EUR exit. The situation is very fluid as we go to press, with yet another eurogroup and EU summit scheduled for July 7.

Despite all this, our forecasts are unchanged - we look for EUR/USD to remain rangebound in 2015 (assuming Greece remains within the Euro area which has been and still is our base case). In the event that we are wrong and Greece does leave the Euro area we would expect EUR/USD to test parity. The uncertainty surrounding a Greek exit would make a September Fed hike less likely (NY Fed President Dudley has warned the market may be too complacent in the event of an exit) but we would still expect EUR to be the main loser in FX.

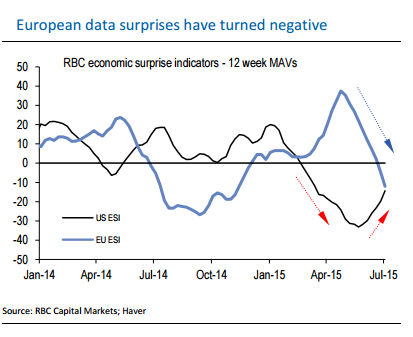

The ECB would be expected to ease further to avoid any threat of contagion while there is a long-term impact in turning EUR into nothing more than a fixed peg. EUR's reaction to Greek developments so far has been limited - in part that seems to be market expectation that Europeans will "sort this out at the last minute" as that has been the lesson of the last five years. Outside of Greece, we have spent some time looking at financial conditions in the Euro area. We put together an 'ECG' (European Conditions Gauge): a barometer for Euro area market conditions based on EUR, 10y Bund yields and Euro Stoxx 50. Rapid rises in this ECG usually come ahead of softening survey/business sentiment data and we are already beginning to see evidence of this in our European economic surprise indicator.

Our Euro area ESI was very positive earlier this year, peaking at 64 in early/mid April. But since then it has turned negative and has been below zero since early May. The FX implication is that EUR rallies should be capped. Our technical analysts see the risks skewed towards a retest of the prior lows. The May low of 1.0815 is the first target; below there support is at 1.0465 and 1.0521. On the topside initial and secondary trendline resistance comes in at 1.1292 and 1.1424 with the 200dMA at 1.1609 representing much stronger resistance.

6 - 12 Month Outlook - Modest recovery

Further out, we still look for a modest EUR recovery, as the positive effects of QE/credit easing feed through. The economic recovery will take time to feed into higher inflation capping our longer-term forecasts.

Currency Outlook: Euro

Monday, July 6, 2015 11:47 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX