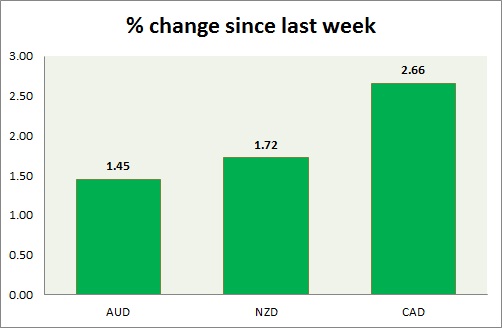

Commodity pairs (AUD, NZD, & CAD) continue their slide against dollar in today's trading. A chart and table is attached for explanation.

- Aussie sailed into further losses as key level got broken in yesterday's trading. Home loans growth fell in January by -3.5%. Aussie is currently trading at 0.757 against dollar. Next target looks like 0.745. Price pattern suggests the pair might fall as low as 0.706, should the resistance at 0.80 holds. Immediate Support lies at 0.741 & Resistance 0.77.

- Kiwi is the top loser this week and continues to decline ahead of today's RBNZ policy decision Losses might accelerate should the central bank cut rates. Pair is currently trading at support 0.72. Immediate Support lies at 0.72, 0.695 & Resistance 0.744.

- Canadian dollar has broken from the recent squeeze and looks like all set to challenge the recent high around 1.285. Price pattern suggests that it could rally further and break above the high made in January. Next target could be 1.305. Extreme target reading is falling as high as 1.38. Currently trading at 1.278. Immediate Support lies at 1.258, 1.24 & Resistance 1.284.

|

AUD |

-1.75% |

|

NZD |

-1.91% |

|

CAD |

-1.17% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings