Dollar index trading at 94.14 (+0.11%)

Strength meter (today so far) – Aussie -0.49%, Kiwi -0.22%, Loonie -0.50%

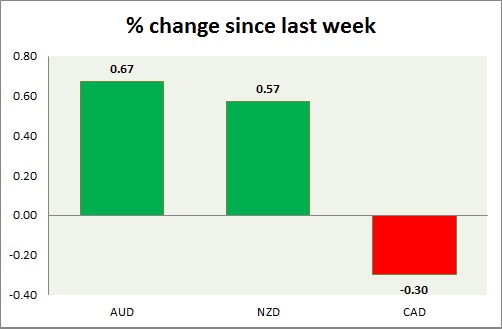

Strength meter (since last week) – Aussie +0.67%, Kiwi +0.57%, Loonie -0.30%

AUD/USD –

Trading at 0.761

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.72, Medium term – 0.75, Short term – 0.75

Resistance –

- Long term – 0.825, Medium term – 0.8, Short term – 0.77

Economic release today –

- Q1 current account deficit at $10.5 billion.

- RBA kept interest rates unchanged at 1.5 percent at today’s meeting.

Commentary –

- The 0.75 area break is turning out to be a false breakout. Aussie recovered from earlier loss as the dollar declines from key resistance.

NZD/USD -

Trading at 0.701

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.68, Medium term – 0.69, Short term – 0.69(testing)

Resistance –

- Long term – 0.76, Medium term – 0.735, Short term – 0.735

Economic release today –

- Global dairy auction is scheduled today.

Commentary –

- Kiwi is up on a weaker dollar as it finds support near 0.69 area.

USD/CAD –

Trading at 1.299

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.22, Medium term – 1.24, Short term – 1.25

Resistance –

- Long term – 1.32, Medium term – 1.3, Short term – 1.30

Economic release today –

- Q1 Labor productivity down 0.3 percent in Q1.

Commentary –

- Loonie is the worst performer this week so far. The focus is on trade talks.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022