Dollar index trading at 98 (+0.61%).

Strength meter (today so far) - Aussie -1.25%, Kiwi -0.56%, Loonie -0.61%.

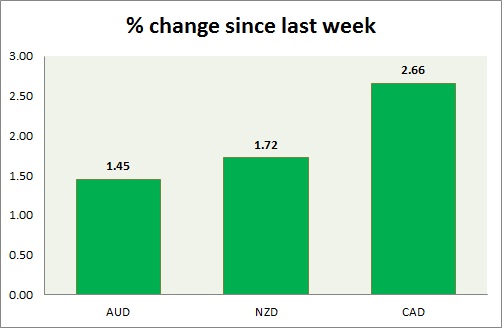

Strength meter (since last week) - Aussie -1.25%, Kiwi -0.56%, Loonie -0.61%.

AUD/USD -

Trading at 0.765

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance/Buy support

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.763-0.765

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80

Economic release today -

- NIL

Commentary -

- Aussie is worst performer today. Price is trading close to immediate support zone. Some bounce back is possible over next few sessions.

- Inverted hammer appeared in weekly chart. Bias remains downwards.

NZD/USD -

Trading at 0.752

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Sell/Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.76-0.762

Economic release today -

- NIL

Commentary -

- Kiwi is relatively better performer, however facing downward pressure amid stronger dollar.

- Very bearish with long upper shadow appeared in week chart. Very close to a grave stone doji. Bias downwards.

USD/CAD -

Trading at 1.269

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.247-1.245

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.284

Economic release today -

- Industrial product price grew by 1.8% mom in February.

- Raw material price index rose 6.1% mom in February.

Commentary -

- Canadian dollar successfully bounced back from lower bound of the range as crude oil failed to gain traction. Loonie might now be aiming for the higher bound.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand