Dollar index trading at 99.31 (-0.04%).

Strength meter (today so far) - Aussie -1.13%, Kiwi -0.97%, Loonie -0.15%.

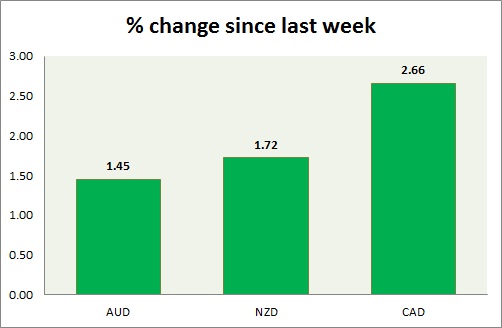

Strength meter (since last week) - Aussie -1.13%, Kiwi -0.97%, Loonie -0.15%.

AUD/USD -

Trading at 0.758

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.771-0.773

Economic release today -

- NIL

Commentary -

- Aussie is the worst performing currency today so far, after being best last week. Weaker import statistics and fall of iron ore led commodities is keeping the bear in charge.

- Breaking of Support zone of 0.756-0.75 would give rise to rapid sell offs.

NZD/USD -

Trading at 0.744

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.75-0.753

Economic release today -

- NZIER business confidence for first quarter to be released at 22:00 GMT

Commentary -

- Kiwi as expected has broken below, the rising trend channel support around 0.75, further downside is expected this week.

- Weaker exports by China, is weighing on price. China's imports for first two months dropped 40% y/y from New Zealand.

- Bearish doji with long upper shadow remains in focus in weekly chart. Very close to a grave stone doji. Bias is still downwards.

USD/CAD -

Trading at 1.258

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.243-1.24

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284, Immediate - 1.267-1.27

Economic release today -

- NIL

Commentary -

- Loonie is continuing the range, it is expected to get boost, should the WTI break $54 resistance and head higher.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate