Dollar index trading at 99.07 (+0.30%).

Strength meter (today so far) - Aussie -0.08%, Kiwi +0.40%, Loonie -60%.

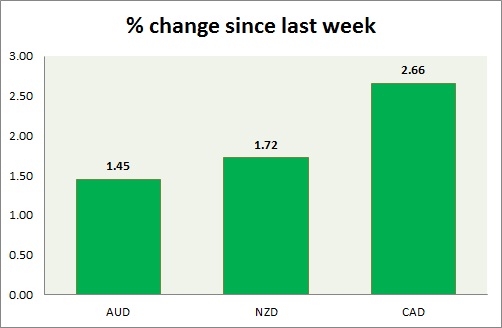

Strength meter (since last week) - Aussie -0.86%, Kiwi +0.25%, Loonie +1.23%.

AUD/USD -

Trading at 0.761

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.771-0.773

Economic release today -

- Westpac consumer confidence dropped by -3.2% in March.

Commentary -

- Aussie has gained grounds amid weaker dollar, however continue to face selling pressure as economic dockets from China point at further weakness.

- Bids remain large so far towards 0.75, a break however might push Aussie towards 0.72 area.

NZD/USD -

Trading at 0.754

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.75-0.753

Economic release today -

- Global dairy trade price index dropped -3.6% in March.

- Business PMI would be released at 22:30 GMT.

Commentary -

- Kiwi bounced back amid weaker dollar, however bias remains downwards.

- Bearish doji with long upper shadow remains in focus in weekly chart. Very close to a grave stone doji.

USD/CAD -

Trading at 1.241

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.243-1.24

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284, Immediate - 1.267-1.27

Economic release today -

- BOC kept rates on hold.

- Manufacturing shipments dropped -1.7% in February.

Commentary -

- Loonie is the best performer this week and today as BOC kept monetary policy on hold and raised inflation forecast.

- Loonie is now trading at support area. Press conference at 16:15 GMT by Governor Poloz might provide guidance, wheather price will break or keep consolidating.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand