Dollar index trading at 96.96 (+0.09%).

Strength meter (today so far) - Aussie -0.18%, Kiwi -0.90%, Loonie -0.64%.

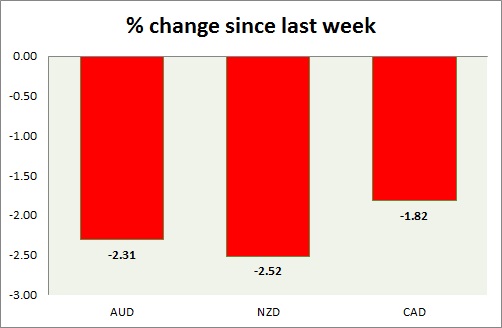

Strength meter (since last week) - Aussie -2.31%, Kiwi -2.52%, Loonie -1.82%.

AUD/USD -

Trading at 0.764

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796, Immediate -0.787

Economic release today -

- HIA new home sales grew 0.6% m/m in April and private sector credit grew at 6.1% from a year ago.

Commentary -

- Aussie selloffs have stabilized as price stands very close to crucial short term support. Selloffs are likely to resume at rallies.

NZD/USD -

Trading at 0.711

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712(broken), Short term - 0.71

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.719-0.721

Economic release today -

- ANZ survey showed business confidence waned in May with headline index falling 15 points. Inflation expectations reached record low at 1.6%

Commentary -

- Kiwi selloffs gathered pace once more today making it the worst performer this week. Selling the rallies are recommended. Support area of 0.72-0.712 is broken. 0.70 will act as vital psychological support.

USD/CAD -

Trading at 1.25

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217, Immediate - 1.238-1.236

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28

Economic release today -

- GDP shrank by -0.6%, worse than expected +0.2% growth.

Commentary -

- Crude jump back provided some support to the economy, however worse than expected GDP data spoiled the mood.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings