Dollar index trading at 101.05 (-0.40%)

Strength meter (today so far) – Aussie -0.14%, Kiwi -0.08%, Loonie -0.02%

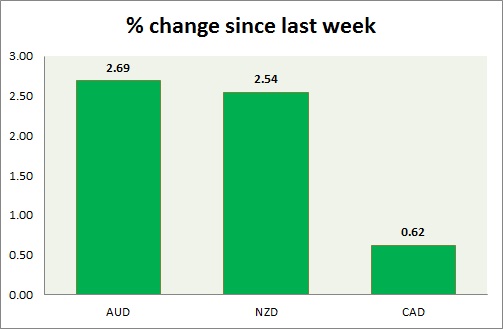

Strength meter (since last week) – Aussie +2.69%, Kiwi +2.54%, Loonie +0.62%

AUD/USD –

Trading at 0.747

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- NIL

Commentary –

- Australian dollar remains as the best performer among all major currencies riding on stronger metal prices and the dollar weakness post-Trump press conference. Aussie is testing key resistance at 0.75 area. There is likely to be a correction.

NZD/USD –

Trading at 0.711

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL

Commentary –

- Kiwi have found some support around 0.69 area and now looking to benefit from the weakness in the dollar. However, selling pressure is quite high.

USD/CAD –

Trading at 1.315

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- NIL

Commentary –

- Loonie is the worst performer among commodity pairs but performance improved as the oil price recovered amid weaker dollar. We expect the loonie to reach 1.375 and 1.4.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022