Dollar index trading at 97.41 (+0.23%)

Strength meter (today so far) - Aussie -0.48%, Kiwi +0.05%, Loonie -0.58%.

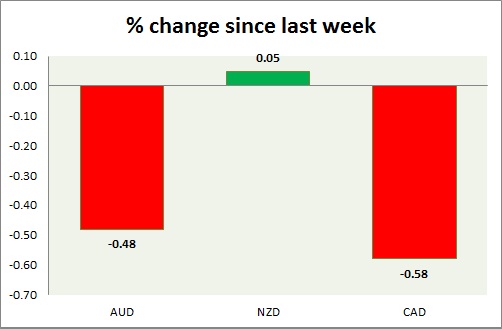

Strength meter (since last week) - Aussie -0.48%, Kiwi +0.05%, Loonie -0.58%.

AUD/USD -

Trading at 0.726

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- TD securities inflation rose by 0.2% in July, up 1.6% from a year ago.

- HIA new home sales rose by 0.5% in June from May.

Commentary -

- Aussie is likely to trade with downside bias. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.659

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/sell

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL

Commentary -

- Kiwi remains sell, however 0.65 is unlikely to break easily, might even result in large bounce back

USD/CAD -

Trading at 1.316

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.31 (broken), Short term - 1.30 (broken)

Economic release today -

- NIL

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. lower crude price is creating havoc for Loonie.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?