Dollar index trading at 96.21 (+0.02%)

Strength meter (today so far) – Aussie +0.23%, Kiwi -0.05%, Loonie +0.66%

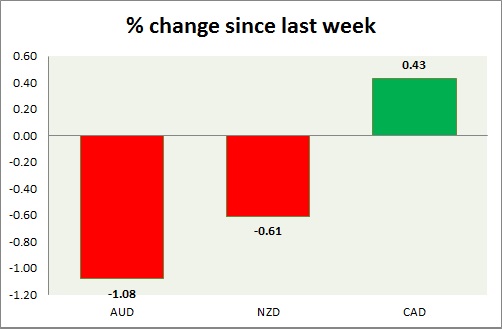

Strength meter (since last week) – Aussie -1.08%, Kiwi -0.61%, Loonie +0.43%

AUD/USD –

Trading at 0.76

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.716, Medium term – 0.735, Short term – 0.746

Resistance –

- Long term – 0.785, Medium term – 0.777, Short term – 0.765 (testing)

Economic release today –

- NIL.

Commentary –

- Aussie is the worst performer this week as RBA maintained neutral policy outlook. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.728

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.73

Economic release today –

- NIL

Commentary –

- Kiwi is continuing its testing of key resistance around 0.73 area.

USD/CAD –

Trading at 1.289

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/sell

Support –

- Long term – 1.3, Medium term – 1.3, Short term – 1.30 (broken)

Resistance –

- Long term – 1.38, Medium term – 1.35, Short term – 1.32

Economic release today –

- Unemployment rate declined to 6.5 percent as employment grew by 45,300

- IVEY PMI report will be published at 14:00 GMT.

Commentary –

- After the superb performance last week, the loonie is the best performer of the week. It is the only one positive against the dollar this week. Hawkish BoC is pushing Loonie higher despite weaker oil price.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed