Dollar index trading at 93.41 (+0.00%)

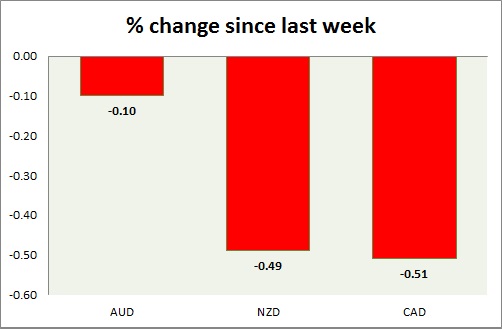

Strength meter (today so far) – Aussie -0.12%, Kiwi -0.50%, Loonie -0.53%

Strength meter (since last week) – Aussie -0.12%, Kiwi -0.50%, Loonie -0.53%

AUD/USD –

Trading at 0.791

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.77

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8 (testing)

Economic release today –

- NIL

Commentary –

- Aussie is enjoying a major breakout, likely to rise towards 0.82 against the dollar. It is down this week on recovering dollar and profit bookings.

NZD/USD –

Trading at 0.736

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.69, Medium term – 0.71, Short term – 0.73

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.75 (testing)

Economic release today –

- NIL

Commentary –

- Kiwi pulls back ahead of RBNZ rate decision on Wednesday. Active call – Buy Kiwi targeting 0.825

USD/CAD –

Trading at 1.267

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.22, Medium term – 1.235, Short term – 1.235

Resistance –

- Long term – 1.32, Medium term – 1.295, Short term – 1.28

Economic release today –

- NIL.

Commentary –

- After weeks of outperformance, the loonie is the worst performer of the day on weaker oil price and recovering dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed