Dollar index trading at 96.13 (-0.11%)

Strength meter (today so far) - Aussie +0.36%, Kiwi -0.40%, Loonie -0.23%.

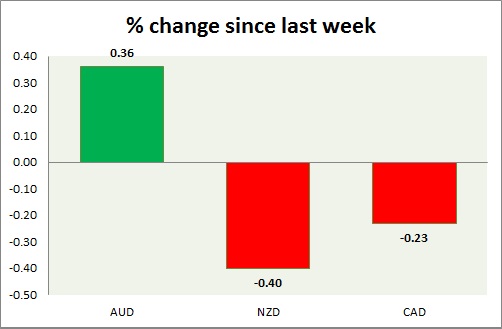

Strength meter (since last week) - Aussie +0.36%, Kiwi -0.40%, Loonie -0.23%.

AUD/USD -

Trading at 0.693

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.705

Economic release today -

- ANZ job advertisement rose by 1% in August.

Commentary -

- Aussie is the best performer today, over profit booking but further decline likely. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.625

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.65

Economic release today -

- Manufacturing retail sales scheduled at 22:45 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi is the worst performer today.

USD/CAD -

Trading at 1.331

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- NIL

Commentary -

- Loonie lost grounds as oil price dropped sharply further.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand