Dollar index trading at 95.94 (-0.08%)

Strength meter (today so far) - Aussie +0.41%, Kiwi +0.94%, Loonie -0.20%.

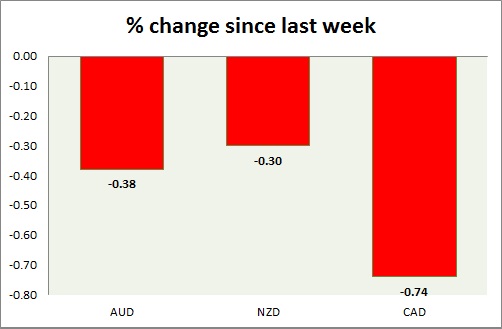

Strength meter (since last week) - Aussie -0.38%, Kiwi -0.30%, Loonie -0.74%.

AUD/USD -

Trading at 0.699

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy

Support -

- Long term - 0.60, Medium term - 0.65, Short term - 0.685, immediate - 0.695

Resistance -

- Long term - 0.83, Medium term - 0.725, Short term - 0.725

Economic release today -

- NIL

Commentary -

- Aussie is relatively better performer today but further slide likely. Sell Aussie @ 0.76 with stop around 0.785 and 0.825 to target 0.715, 0.70, 0.685 and 0.65.

NZD/USD -

Trading at 0.636

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.615

Resistance -

- Long term - 0.71, Medium term - 0.68, Short term - 0.643-0.65

Economic release today -

- Building permits to be released at 23:50 GMT.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. No change in trend is still at sight.

USD/CAD -

Trading at 1.342

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.19, Medium term - 1.26, Short term - 1.29, immediate -1.32

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.35

Economic release today -

- Industrial product price index dropped by -0.3% in August from July.

Commentary -

- Loonie reached lowest level in more than 11 years against Dollar. Steady deterioration suggests market's expectations of further policy easing. Failed to gain on stronger oil price today.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand