Dollar index trading at 94.75 (-0.12%).

Strength meter (today so far) - Euro +0.12%, Franc -0.11%, Yen +0.20%, GBP +0.22%

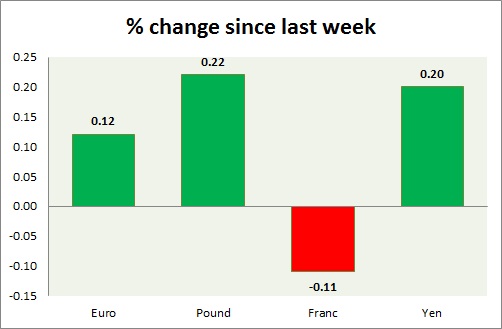

Strength meter (since last week) - Euro +0.12%, Franc -0.11%, Yen +0.20%, GBP +0.22%

EUR/USD -

Trading at 1.137

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085, Immediate - 1.109

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.145

Economic release today -

- NIL.

Commentary -

- Euro is hovering above 1.132 resistance area, further rise towards 1.157 is likely.

GBP/USD -

Trading at 1.534

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.572, Immediate - 1.55

Economic release today -

- CB leading economic index rose by 0.2% in September.

Commentary -

- Bank of England (BOE) rate hike bets fading in Pound. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 119.9

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 118.6

Resistance -

- Long term - 130, Medium term - 126, Short term - 121.7, Immediate - 120.5

Economic release today -

- NIL

Commentary -

- Yen regained some ground as stimulus hope disappears after Kuroda comments. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122.

USD/CHF -

Trading at 0.961

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93, Immediate -0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is gaining as Dollar is weakening across the board, support around 0.95 is critical. Active Call - Buy USD/CHF with target around 1.03 area and stop around 0.95 area.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate