Dollar index trading at 99.51 (-0.16%).

Strength meter (today so far) - Euro +0.25%, Franc -0.23%, Yen +0.01%, GBP -0.01%

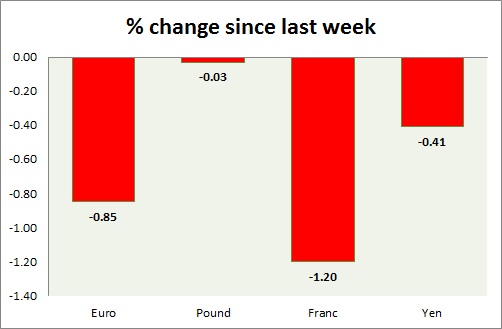

Strength meter (since last week) - Euro -0.85%, Franc -1.20%, Yen -0.41%, GBP -0.03%

EUR/USD -

Trading at 1.067

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.06

Resistance -

- Long term - 1.175-1.18, Medium term - 1.15, Short term - 1.11, Immediate - 1.08 area

Economic release today -

- Construction output declined by -0.4% in September.

Commentary -

- Euro struggling to break below 1.06, while 1.07 acting as support .Active call - Euro to drop towards parity.

GBP/USD -

Trading at 1.52

Trend meter -

- Long term - Buy, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.5

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.55, Immediate - 1.53

Economic release today -

- NIL

Commentary -

- Pound remains the best performer this week hovering around 1.52. Active call - Sell Pound @1.54 targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 123.4

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 116-115, Short term - 119.5

Resistance -

- Long term - 130, Medium term - 126, Short term - 123.5

Economic release today -

- NIL

Commentary -

- Yen is hovering above 123 area, awaiting FOMC minutes. Active call - Buy USD/JPY @ 121.9 targeting 123.2, 125, 127, with stop loss around 120, 118.

USD/CHF -

Trading at 1.017

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.93, Short term - 0.95, Immediate -0.98

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 1.025

Economic release today -

- Zew survey expectation dropped to zero in November from 18.3 prior.

Commentary -

- SNB probably increased intervention heading into European central bank meeting in less than three weeks.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary